Doing good for the right reasons: AMP Capital’s ethical foundations

Opinion + AnalysisBusiness + Leadership

BY Simon Longstaff ethics 21 MAR 2017

Discover the ethical processes behind AMP Capital’s tobacco divestment. There are three years of thinking behind those headlines, explains Simon Longstaff. He was there to help them through.

You may have seen that AMP Capital decided to divest from tobacco and munitions. The organisation will sell A$440 million of tobacco investments and a further A$130 million in cluster munitions and landmines.

Although this is big news, it isn’t the first time a divestment like this has happened in Australia. What makes this news more significant is AMP Capital’s decision hasn’t come from traditional divestment strategies like shareholder activism or social protest. Instead, it is the product of a much larger process of ethical reflection.

This reflection started three years ago, when AMP Capital approached me, wanting to set its entire investment portfolio on a solid ethical foundation. Together, we sought to discover what that foundation might be.

What we learned surprised us. At first, we thought ‘fiduciary duty’ would be the main issue – AMP Capital’s duty to act in the best interests of its investors. AMP Capital is totally committed to discharging this obligation.

However, it turns out that there was another equally important issue – one that is for the most part ignored.

It concerns AMP Capital itself. Is it driven entirely by the ethics of others, washing its hands of all ethical responsibility? Or does AMP Capital have a right to set the ethical boundaries within which it offers its goods and services in the expectation of reward?

We concluded that just as a person can decide not to do something that goes against their conscience, so can a business.

Once we’d agreed on this basic idea, AMP Capital was able to build an ethical investment foundation based on a few core principles that we believed to be self-evident and so firmly grounded as to be uncontroversial. They are:

- No investment may be made if it leads to or supports conduct that violates the principle of ‘respect for persons’. AMP Capital will not invest in entities or activities that undermine fundamental human dignity, like those that treat people merely as a tool for some other end.

- AMP Capital will not enable – or seek to profit from – activities that violate international human rights law.

- AMP Capital will actively consider the extent to which its investments are in entities or products that cause harm. The relevant test is this – to what extent (if any) can this product be used without causing harm to the user or others?

- In assessing harm, AMP Capital will seek to determine the extent any harm is an inescapable side-effect of doing something good. If harm is inescapable, are the adverse side-effects mitigated to the greatest extent possible?

- AMP Capital will have regard to issues of ‘materiality’ – are the ethically problematic issues central to the investment being considered? AMP Capital will also bear in mind whether engagement with a company might be a better route to achieving a positive ethical outcome.

- AMP Capital will be open to being corrected if they’re mistaken about any of the facts or assumptions that have a bearing on deciding if a company’s conduct or products are harmful.

This framework can be applied to any situation. Regardless of the product or moment, it gives a strong ethical foundation for all the choices the company might make in the future.

Good foundations are something that every company needs. If embedded and practiced, they can reassure employees and customers that business choices are based on ethical reflection rather than the pressure of public opinion or the pursuit of profits at all cost. And they bring consistency and confidence to ethical decisions.

I’m very proud to have worked with AMP Capital on developing this framework. I hope it helps them and inspires others to do the same.

MOST POPULAR

ArticleSOCIETY + CULTURE

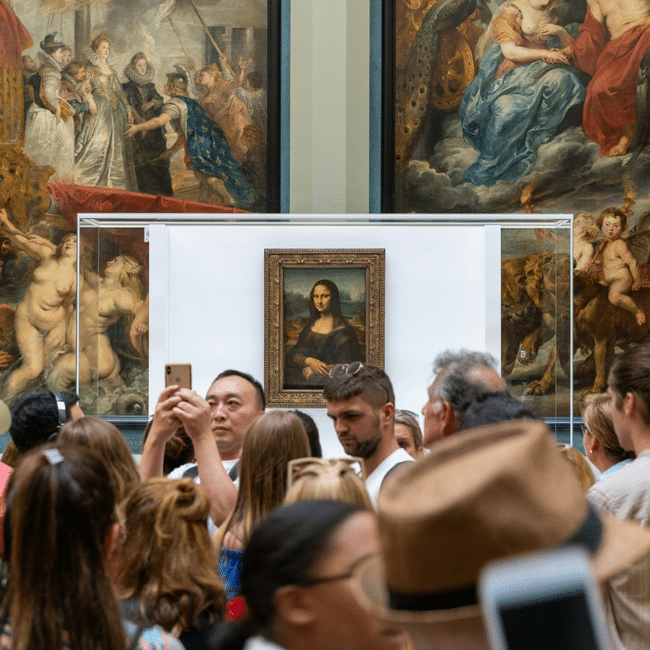

Who’s to blame for overtourism?

EssayBUSINESS + LEADERSHIP

Understanding the nature of conflicts of interest

ArticleBeing Human

The problem with Australian identity

EssayBUSINESS + LEADERSHIP