Can philosophy help us when it comes to defining tax fairness?

Can philosophy help us when it comes to defining tax fairness?

Opinion + AnalysisBusiness + LeadershipPolitics + Human Rights

BY Joshua Pearl 31 MAR 2023

Nothing is certain, except death and taxes. We can’t make the former fair but we can at least try when it comes to taxation.

Tax is fundamental to government. It is essential to fund the services we require to live in a modern society, including military, police, judiciary, roads, healthcare and education. It has also become more important in recent decades. At the time of Federation, the Australian tax system collected around 5% of GDP. Today this number stands at around 29%.

But is it fair? Are we paying too little or too much tax? Should those with greater means pay more? These are questions that must be asked of any tax system, and two works by philosophers offer very different answers.

The first is Robert Nozick’s Anarchy State and Utopia. It argues that individuals (and, by extension, the corporations they own) ought to own 100% of their income. Individual property rights are paramount, and any taxation beyond what is required to protect borders and protect these property rights is unjust. In short: only public expenditure on the police and military can be justified.

One of Nozick’s more colourful claims is that taxation is on par with forced labour. Tax forces workers to work in part for themselves, and in part for government.

But while Anarchy State and Utopia is a cult favourite of many modern-styled libertarians arguing for lower taxes, most people consider its position on tax unfair. Many find the consequences of the gross inequalities Nozick permits objectionable, while others argue a child’s right to public education, or a citizen’s right to universal healthcare, outweighs the right individuals or corporations have to their pre-tax wealth and income.

An additional issue for Nozick is how to determine who funds the military and police. Should it be a fee for service? And if so, does this mean only the very wealthy who pay tax should enforce property rights, given they have the most to benefit and lose without military and police? Or should everyone pay an equal amount of tax, regardless of their income or wealth or their ability to pay? (The fallout of this was seen in the 1990’s in the UK when a Thatcher Government head tax proposal was met with violence and riots in the street).

The other side of the tax coin

The second perspective comes from Thomas Nagel and Liam Murphy in their book The Myth of Ownership. They tackle the definition of tax fairness in a nearly opposite way to Nozick. They argue that it does not make sense that citizens have full (or any) rights to their pre-tax income and wealth because income and wealth cannot exist without government. Individual and corporate incomes, and the level of incomes, occur because of the existence of government, not despite it.

They have a point. A successful Australian economy requires the enforcement of law, market regulation, monetary policy (not least for the currency we use), and regulation that prohibits collusion, intimidation and other forms of business malpractice. A banker earns money because the government has mandated a currency – and she keeps her money because property rights exist. A lawyer’s income occurs because of the legal system, not despite it. We might also argue that a successful Australian economy requires investments in public education and public healthcare.

Yet, while individual and corporate income may be contingent on the existence of government, and markets might not be considered perfectly fair nor free, it doesn’t follow that market determined outcomes are completely arbitrary. We often say that someone deserves to earn more if they work harder. So if someone decides to go to university or undertake a trade, rather than surf all day, we might think they deserve a higher salary.

This very simple point (not to mention the very real practical issues with discarding market-based outcomes) mean Nagel and Murphy, like Nozick, fail to provide a complete blueprint for us to determine tax fairness. Nozick fails because he assumes market distributions are 100% fair; Nagel and Murphy fail because they assume market distributions (and any and all inputs that determine these distributions such as hard work and effort) are irrelevant.

And yet both philosophies help us focus on important tax fairness elements. Nagel and Murphy show it is important to focus on people’s post-tax positions and effectively highlight that pre-tax market determined income and wealth are not necessarily “fair”, largely because these incomes and wealth cannot exist without tax and government. Nozick effectively highlights that income and corporate tax can only be justified if associated government expenditure can also be justified.

Even if you find that neither of these perspectives to be the right one, they help establish the parameters of a fair tax system. It’s then up to us to inject our values to determine which system is right for the kind of society we wish to live in.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Accountability the missing piece in Business Roundtable statement

Opinion + Analysis

Business + Leadership

Explainer: Getting to know Richard Branson’s B Team

Opinion + Analysis

Politics + Human Rights

Time for Morrison’s ‘quiet Australians’ to roar

Opinion + Analysis

Politics + Human Rights

We are witnessing just how fragile liberal democracy is – it’s up to us to strengthen its foundations

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

Why fairness is integral to tax policy

Why fairness is integral to tax policy

Opinion + AnalysisBusiness + LeadershipPolitics + Human Rights

BY Joshua Pearl 22 AUG 2022

Pick up a first-year undergraduate economics textbook on tax and you’ll likely be apprised that there are three desired features of a tax policy: simplicity, efficiency and fairness.

The importance of the first two are somewhat obvious. Simplicity, because taxpayers need to understand how to comply with the tax system. Efficiency, because if people can easily change their behaviour to avoid paying tax, there won’t be much revenue to fund government expenditure. But fairness, the third desired feature of tax policy, is more nebulous.

Tax fairness is important not merely because economists tell us so. Rather, Australia needs to consider tax fairness for reasons such as: ensuring the continued political legitimacy of the Australian governments; because tax inherently deals with issues of inequality; and for the very practical reason of helping us deliver tax system reform.

In a liberal country such as Australia, a well-accepted norm is that restrictions on individual freedom must be justified. And in liberal philosophy, the dominate way to justify government restrictions is by considering a “public reason” test, well-articulated by influential twentieth century philosopher John Rawls’ liberal principle of legitimacy:

“Political power is legitimate only when it is exercised in accordance with a constitution (written or unwritten) the essentials of which all citizens, as reasonable and rational, can endorse in the light of their common human reason”.

Restrictions that are arbitrary, unfair, exploitative or focus on benefitting a few at the expense of the many, undermine political legitimacy because they cannot be justified. Prohibiting the Nazi swastika might be justifiable because people have a right not to be vilified or feel physically threatened. But prohibiting tattoos or facial piercings, dress wear, beach outfits or more sinisterly, citizenship based on skin colour, because they offend certain sensibilities, are not legitimate forms of government coercion because they cannot be reasonably justified using the public reason test.

Rawls considered the public reason test would apply to areas in the public domain relating to judges, government officials, and politicians. And the public reason test applies to taxation as much as any other act of government coercion. Taxation, the compulsory, unrequited payment to government, is quite literally nothing, if it is not coercive. In Australia we pay around $600bn in tax each year, over $40,000 per working person.

If the tax system is unfair, it cannot be justified. And taxation that is unjustified etches away at the political legitimacy of the Australian government and, in turn, Australian democracy.

The two primary functions of tax are:

1. to fund public goods such as military, transport, education, police and the judiciary

2. to redistribute wealth and income, through policies such as pension payments, unemployment payments, childcare and paid parental leave. Therefore, because tax impacts wealth and income distribution, as well as economic inequality, the tax system has inherent fairness implications.

Wealth and income distribution, the second function of tax, determines economic inequality, an inherent fairness issue. And to determine the required tax level requires consideration of the level of wealth and income inequality we consider fair. It might be said this issue is more relevant today than in other times in our recent history; Australian inequality measures have increased steadily since the 1980s. But even if we consider current wealth and income inequality levels as acceptable, presumably there is a limit. It is unlikely that Australia would still be considered a fair country if we were a nation of 20 billionaires and twenty million paupers.

One might be tempted to try and decouple tax issues from fairness issues by claiming Australia and our tax system is fair so long as we have equality of opportunity; instead of worrying about wealth inequality and tax, we should focus on realising Australian cultural values such as a “fair go”, a value synonymous (according to the citizenship tests new citizens take) with “equality of opportunity”.

However, a “fair go” isn’t free. For a rich child and a poor child to have the same opportunities with respect to education, learning and a successful career, we require tax. For equality of opportunity to exist, the rich parent needs to contribute more tax to fund our education institutions than what the poor parent can afford. Here, issues of tax and fairness are bound.

A less philosophical reason as to why it’s important for Australia to consider tax system fairness relates to tax reform. The consensus among economists is the Australian tax system is uncompetitive, inefficient, too complex and out of date. And they may have a point.

Australia hasn’t had meaningful tax reform for decades and is out of step with international best practice. The Federal Government deficit is large and growing, thanks in part to the former government’s COVID-19 splurges (some necessary, some arguably less so). And Australian government debt is forecast to reach a trillion dollars in the coming years, a level that may limit or preclude policy responses to future wars, pandemics, financial crises or property market crashes (and the implications of muted policy options is not merely no pink batts or no JobKeeper in time of catastrophe, but no jobs, high unemployment and potential social unrest).

Yet despite the arguments of a host of economic experts, such as ANU’s Professor Robert Breunig the former Federal Treasury head Dr. Ken Henry, OECD and IMF mandarins, to name but a few, the Australian tax system remains as it is. While tax reform by its nature is challenging (there is always a loser – someone will be paying more), it’s hard not to think the focus on tax efficiency, tax competitiveness, tax complexity and so on and so forth, has failed to create the “burning platform” needed to drive policy change. A greater focus on the fairness of the Australian tax system may be what is required to buttress the valid but sometimes technical economic arguments for Australian tax system reform.

Considering fairness of the tax system is important for political legitimacy, inequality and practical reasons. A tax system that is fair strengthens our democracy by ensuring taxation remains justifiable. Tax fairness helps us realise Australian cultural values such as equality of opportunity. And a greater focus on tax fairness might help us undertake meaningful tax reform, delivering a tax system that is simple, efficient and fair.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

David Gonski on corporate responsibility

Opinion + Analysis

Business + Leadership

Perils of an unforgiving workplace

Opinion + Analysis

Business + Leadership

Why Australian billionaires must think “less about the size of their yard” and more about philanthropy

Opinion + Analysis

Business + Leadership

Has passivity contributed to the rise of corrupt lawyers?

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

Is the right to die about rights or consequences?

Is the right to die about rights or consequences?

Opinion + AnalysisPolitics + Human Rights

BY Joshua Pearl 31 JAN 2022

Of all public policy debates, voluntary assisted dying is an ethical debate as much as any other, made clear by the recent impassioned speeches on the floor of the New South Wales parliament and the accompanying public debate.

The various arguments for and against voluntary assisted dying are motivated by a range of different reasons. For some it’s by personal experiences and time spent with dying loved ones. For others it’s by views on human dignity – reasons that are used both for and against. Many arguments are motivated instead by a deep belief in the existence of God, and what this means for how we treat others.

While there may be no “best way” to consider and assess the case for and against voluntary-assisted-dying, it seems to me that a useful approach is to focus on two central ethical issues:

- The level of rights an individual has over their body

- Whether legalised voluntary assisted dying makes a society worse-off due to the negative consequences that may ensue, such as increased self-harm in the broader population or individuals being pressured to prematurely end their lives.

The rights case for voluntary assisted dying largely centres on an individual’s self-ownership rights – what they are permitted to do with their bodies. These rights do not rest on any consequential benefits that might arise, such as a more cohesive society or a happier public, but are natural rights, without further need of justification.

If people have self-ownership rights in a strong sense – for example, they can do as they please with their bodies, free from any external government interference – then it seems the proposed NSW voluntary assisted dying bill does not go far enough.

Patients must have a condition that is advanced, progressive and will cause death within six months (or 12 months for a neurodegenerative disease). This timeframe appears unfair because it means patients with higher levels of pain who are further from the relief of death will suffer more, for longer. If anything, a person experiencing a higher level of pain has a greater need for voluntary assisted dying. If we regard incurable psychological suffering as an affliction comparable with physical suffering (a possibility it seems we do take seriously as a society), failing to provide relief for this cohort seems if not unfair, then at least inconsistent.

However, our existing social norms suggest self-ownership rights are not inviolable. We are not allowed to sell our organs, even if to save another person’s life (we can donate them). We are not allowed to sell ourselves into slavery, even if this could raise vital funds our families or children need to lead better lives.

When we impose risks that are great enough, either to ourselves or others, we are restricted from doing things as menial as leaving home after dark, as was the case in parts of south-west Sydney during the COVID-19 lockdowns. Sometimes these restrictions are publicly justified on the basis of being good for the individual (paternalistic reasons), and other times on the basis of being good for society (what economists might call “externality” reasons).

With regard to consequences, from an individual’s perspective, it seems reasonable to suggest that a condition can be so severe, so acute, that life is not worth living. Our existing medical practices align with this view. It is permissible in NSW for doctors to withdraw life-saving treatment at the request of patients and doctors are under no obligation to provide medical treatment when treatment is considered futile. While there is a difference between killing and letting die, this practice suggests it is possible for the benefits of death to outweigh the costs of life.

Therefore, from a consequentialist perspective, it seems to me the primary issue of concern is whether voluntary assisted dying makes society worse. One argument made is that voluntary assisted dying can increase suicides in the general population and pressure vulnerable people to prematurely end their lives. It seems reasonable to accept this is possible and reasonable to accept that we cannot know with full certainty how legalising voluntary assisted dying will impact NSW.

The primary issue of concern is whether voluntary assisted dying makes society worse.

However, these consequential considerations can be informed by looking at the experience of other jurisdictions. Voluntary assisted dying has been legal in the US states of Oregon, Washington and Vermont since 1997, 2009, and 2013 respectively; legal in the Netherlands and Belgium since 2002; and legal in Switzerland since 1918.

Given both sides of the debate argue the evidence is in favour of their own argument, a useful exercise is for the government to commission an independent non-partisan group of experts to analyse the existing data and academic literature, and publicly report back. This would help inform members of NSW Legislative Council when they consider amendments and vote on voluntary-assisted-dying legislation in 2022.

The non-partisan group would analyse how laws have been introduced in other jurisdictions and how these laws have changed over time. The group would ideally look for evidence of whether voluntary assisted dying has increased general population suicides or self-harm, or pressured individuals to prematurely end their lives. They might even consider whether voluntary assisted dying legalisation has numbed or lessened the community spirit, or negatively (or positively) changed the way a community treats and thinks about death.

An independent non-partisan report would provide a greater understanding of the trade-off between individual rights and social consequences. Should it be the case there is near zero risk of negative social consequences, then the case for voluntary assisted dying would seem unassailable. But if there is a risk of increased general population self-harm (for example), the decision then centres on a threshold issue of what level of risk and what level of social impact we are willing to accept.

We might be willing to accept one additional event of self-harm or we might be willing to accept one hundred. We might even be willing to accept that an individual’s rights over their bodies are so strong that patients in agonising pain have a right to voluntary assisted dying, regardless of the social consequences that might result. That is, we might conclude that individual rights trump social consequences.

Should the voluntary assisted dying bill become law, the NSW experience may differ from other jurisdictions due to a range of policy or cultural reasons, which is why it seems an oversight the proposed bill does not require more in the way of future data collection and future reviews (something that could be undertaken by the proposed Voluntary Assisted Dying Board). This amendment would aid future debates (should the bill be passed by the NSW Legislative Council) on whether voluntary assisted dying should be expanded, amended, or even repealed.

It seems to me, the proposed voluntary assisted dying bill permits too little where rights are concerned by setting too strict a timeframe on nearness to death, and permits too much where consequences are concerned by not adequately taking into account the potential for negative social consequences.

The proposed bill and the ethical debate would be improved by considering ways to treat individuals consistently and fairly, by the government commissioning an independent non-partisan group to publicly report back before the NSW Legislative Council votes on the voluntary assisted dying bill, and by amending the proposed bill to require greater data collection and mandate future reviews.

These measures would enhance our understanding of individual rights and social consequences and enable our politicians to vote with their conscience alongside the relevant facts.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Big thinker

Politics + Human Rights, Relationships

Big Thinker: Adam Smith

Opinion + Analysis

Climate + Environment, Politics + Human Rights

Australia Day: Change the date? Change the nation

Opinion + Analysis

Politics + Human Rights, Society + Culture

When our possibilities seem to collapse

Opinion + Analysis

Politics + Human Rights, Relationships, Society + Culture

In the face of such generosity, how can racism still exist?

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

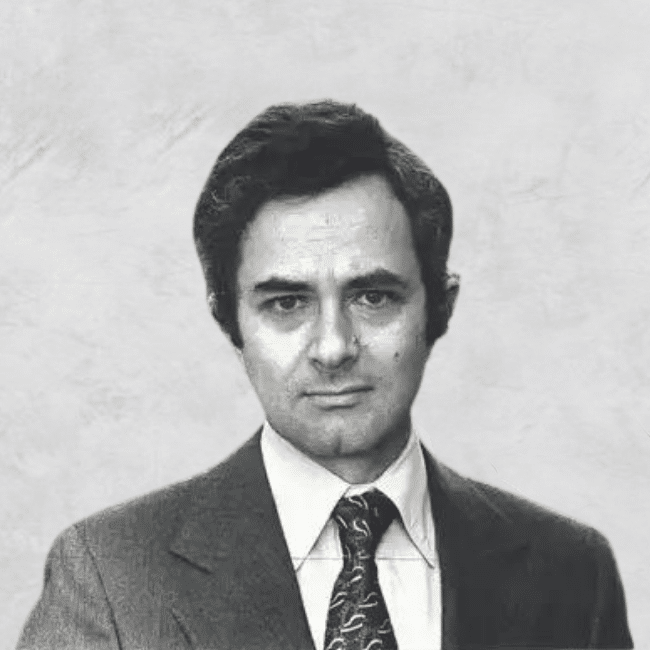

Big Thinker: Thomas Nagel

Thomas Nagel (1937-present) is an American philosopher whose work has spanned ethics, political philosophy, epistemology, metaphysics (the nature of what exists) and, most famously, philosophy of the mind.

An academic philosopher accessible to the general public, an atheist who doubts the materialist theory of evolution – Thomas Nagel is a considered nuanced professor with a rebellious streak.

Born in Belgrade Yugoslavia (present day Serbia) to German Jewish refugees, Nagel grew up in and around New York. Studying first at Cornell University, then the University of Oxford, he completed his PhD at Harvard University under John Rawls, one of the most influential and respected philosophers of the last century. Nagel has taught at New York University for the last four decades.

Subjectivity and Objectivity

A key theme throughout Nagel’s work has been the exploration of the tension between an individual’s subjective view, and how that view exists in an objective world, something he pursues alongside a persistent questioning of mainstream orthodox theories.

Nagel’s most famous work, What Is It Like to Be a Bat? (1974), explores the tension between subjective (personal, internal) and objective (neutral, external) viewpoints by considering human consciousness and arguing the subjective experience cannot be fully explained by the physical aspects of the brain:

“…every subjective phenomenon is essentially connected with a single point of view, and it seems inevitable that an objective, physical theory will abandon that point of view.”

Nagel’s The View From Nowhere (1986) offers both a robust defence and cutting critique of objectivity, in a book described by the Oxford philosopher Mark Kenny as an ideal starting point for the “intelligent novice [to get] an idea of the subject matter of philosophy”. Nagel takes aim at the objective views that assume everything in the universe is reducible to physical elements.

Nagel’s position in Mind and Cosmos (2012) is that non-physical elements, like consciousness, rationality and morality, are fundamental features of the universe and can’t be explained by physical matter. He argues that because (Materialist Neo-) Darwinian theory assumes everything arises from the physical, its theory of nature and life cannot be entirely correct.

The backlash to Mind and Cosmos from those aligned with the scientific establishment was fierce. However, H. Allen Orr, the American evolutionary geneticist, did acknowledge that it is not obvious how consciousness could have originated out of “mere objects” (though he too was largely critical of the book).

And though Nagel is best known for his work in the area of philosophy of the mind, and his exploration of subjective and objective viewpoints, he has made substantial contributions to other domains of philosophy.

Ethics

His first book, The Possibility of Altruism (1970), considered the possibility of objective moral judgments and he has since written on topics such as moral luck, moral dilemmas, war and inequality.

Nagel has analysed the philosophy of taxation, an area largely overlooked by philosophers. The Myth of Ownership (2002), co-written with the Australian philosopher Liam Murphy, questions the prevailing mainstream view that individuals have full property rights over their pre-tax income.

“There is no market without government and no government without taxes … [in] the absence of a legal system [there are] … none of the institutions that make possible the existence of almost all contemporary forms of income and wealth.”

Nagel has a Doctor of Laws (hons.) from Harvard University, has published in various law journals, and in 1987 co-founded with Ronald Dworkin (the famous legal scholar) New York University’s Colloquium in Legal, Political, and Social Philosophy, described as “the hottest thing in town” and “the centerpiece and poster child of the intellectual renaissance at NYU”. The colloquium is still running today.

Alongside his substantial contributions to academic philosophy, Nagel has written numerous book reviews, public interest articles and one of the best introductions to philosophy. In his book what does it all mean?: a very short introduction to philosophy (1987), Nagel leads the reader through various methods of answering fundamental questions like: Can we have free will? What is morality? What is the meaning of life?

The book is less a list of answers, and more an exploration of various approaches, along with the limitations of each. Nagel asks us not to take common ideas and theories for granted, but to critique and analyse them, and develop our own positions. This is an approach Thomas Nagel has taken throughout his career.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Explainer

Relationships

Ethics Explainer: Hope

Explainer

Relationships

Ethics Explainer: Double-Effect Theory

Big thinker

Relationships

Big Thinker: Buddha

Explainer

Politics + Human Rights, Relationships

Ethics Explainer: Gender

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

Does Australian politics need more than just female quotas?

Does Australian politics need more than just female quotas?

Opinion + AnalysisBusiness + Leadership

BY Joshua Pearl 8 OCT 2021

The Labor Party’s recent decision to parachute Kristina Kenneally into the ethnically diverse electorate of Fowler came at the expense of Tu Le, a female Australian lawyer of Vietnamese background.

The decision revealed two things about politics in Australia. First, that female quotas work. Second, that if you are an Australian of Asian heritage, it’s difficult to join the political class. This is not news. The 2018 report by the Australian Human Rights Commission found that while nearly 21% of Australians are from a non-European background (excluding First Nations people who comprise an additional 3%), they make up just four per cent of Australia’s federal politicians.

Scrolling though the list of Australian leaders reveals this lack of representation. Scott, Dom, Dan, Mark, Steve, Pete, Andrew and Mike run the country, alongside one woman, Annastacia. Not one is of non-European background.

It is hard to understate the importance of a representative political class. A political class that acts in its own interests, or in the interests of a select few, is quite simply, not a democracy. A monarch rules to ensure power stays in the family line. An autocrat rules in his self-interest. In a civilian dictatorship, political decision-making rewards some and punishes others, as shown by the Russian and Chinese experience (think Chechens and Uyghurs respectively).

But a democracy is different. And democracy, at its core, is political decision-making that reflects the preferences – and better still, the interests – of the electorate. It is what drives democracy’s ability to achieve broad based economic growth. And it is what underpins the Nobel Prize winner Amartya Sen’s findings that “no substantial famine has ever occurred in any independent country with a democratic form of government and a relatively free press”.

When a democracy’s political class fail to reflect their society, they almost certainly fail to make decisions that best serve the electorate’s interests.

Consider Anthony Albanese. Albanese knows his own interests. He will have a reasonable understanding of other fifty-year-old blokes from Marrickville. But the further he moves out, the less understanding he has. I suspect he does not properly understand the concerns of a typical thirty-year-old woman, and I am nearly certain he has no real sense of the needs and wants of politically under-represented groups such as the Vietnamese community. When Albanese makes decisions that affect politically under-represented communities, it is hard to see how he could be appropriately informed.

An identical point can be made with respect to the Prime Minister, Scott Morrison. Simply replace Marrickville with Cronulla. It is this very reason why country folk want their local members to be country folk, and not people who, living in the city, neither understand the nuances of rural issues, nor have the same “skin in the game”, so to speak.

There are three principal ways to achieve a more representative political class: grassroots movements, targets and quotas. The logic for grassroots movements is that when party members better reflect Australian society, this translates into a similarly representative political class. But the proof is in the pudding. The Liberal and Labor Party have been compelled to introduce female quotas and targets because they have found grassroots movements to be insufficient. Targets are what is hoped for, but are not binding. But based on the Liberal Party’s experience with its target of 50% female representation across Australian parliaments by 2025, targets seem similarly impotent. Women account for just 28% of Liberal parliamentarians.

The most effective method to ensure the political class reflects society is quotas, something borne out by the international experience in Canada, New Zealand, Mexico and Sweden, and the domestic experience of the Australian Labor Party. When Labor first introduced female quotas in 1994, 13% of federal Labor parliamentarians were women. Today it is 48%.

There are a number of arguments against quotas. One is that quotas undermine politicians who are members of the quota group. But is Penny Wong’s career tainted by the fact that Labor has a female quota? And would we really think any less of Julie Bishop or Gladys Berejiklian had the Liberal Party had female quotas?

Another is that quotas are not “very democratic”. But this misunderstands democracy. Democracy is about collective decision-making that is responsive to the interests of citizens. It is not an unfettered Labor and Coalition duopoly, led by a handful of party executives and the estimated 1% of Australians who are party members (and if you think it is not a duopoly, try and name the last federal cabinet minister who wasn’t a member of one of these parties). Both groups have obligations that stretch beyond party members, and extend to all Australians. But do they recognise these duties? And how easily are they set aside when at odds with the interests of the party or the individual politician?

The argument against quotas that appears to have some merit is that quotas risk overruling other desirable characteristics such as intellectual capacity, political charisma or work ethic. This is not to say that under-represented groups don’t have equally great candidates. Rather, it acknowledges that in snap elections, or when relevant political branches or parties are disorganised or dysfunctional, the need to meet quotas may trump other factors.

And yet this overstates the purity of our preselection system. Deals get done. Mistakes happen. There are poorly qualified politicians who have won out over better qualified people. Sometimes the individuals we elect are criminals and other times they simply aren’t up to the job. It is unlikely well-defined quotas undermine the quality of our political class. Indeed, the evidence is pretty clear that the current system has led to the election of people who would never get into parliament if merit was the determining factor.

The argument for quotas based on ethnic or cultural background, sexual orientation or disability status, is not a popular one. Yet if female quotas are justified, it is difficult to see how quotas for other under-represented groups are not equally justified. There is, naturally, a limit to the number of groups that can be included. Groups would need to have a certain critical mass, be qualitatively different to other groups and be comprised of members of relevantly similar backgrounds.

But if we are serious about the need for the political class to reflect society, we should be serious about quotas for more than just women.

A qualification to this general argument is that all who are elected in a representative democracy are bound to bring their best judgement to bear when acting in the interests of the electorate as a whole. That is, the fact a person comes from a particular group does not mean they are its ‘delegate’. The point about quotas is not that one’s identity enables or precludes the possibility of providing ‘representation’ in this broader sense. Rather, quotas ensure that a diverse electorate can have confidence that when judgement is exercised then it will be informed by a range of considerations that include the experiences of all.

An Australian parliament without women or Indigenous people, without rural representatives, or without people of Asian heritage, cannot meet the range of interests of the electorate.. A broader quota policy would help Australia realise a more legitimate version of democracy. It may also mean that added to the names of Bob, Paul, John, Tony, and Julia, is a name like Tu or Dai.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

How ‘ordinary’ people became heroes during the bushfires

Opinion + Analysis

Business + Leadership, Politics + Human Rights

Should corporate Australia have a voice?

Opinion + Analysis

Business + Leadership, Relationships, Science + Technology, Society + Culture

Who does work make you? Severance and the etiquette of labour

Opinion + Analysis

Business + Leadership

The truth isn’t in the numbers

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

Ethics of making money from JobKeeper

Ethics of making money from JobKeeper

Opinion + AnalysisBusiness + Leadership

BY Joshua Pearl The Ethics Centre 10 SEP 2021

Making money from JobKeeper is not just profit maximisation. It’s free-riding.

When the Federal Treasurer announced JobKeeper in March 2020, the COVID-19 pandemic was expected to wreak economic havoc across Australia. Thousands of businesses would go bust. Millions of people would be unemployed. Billions in economic output would be lost. The Australian Government declared the (then) $130bn scheme would maintain “the connection between the employer and the employee” by making cash payments to eligible companies (those anticipating, through self-assessment, at least a 30% fall in revenue) for each employee kept on the books. Australia was bracing for economic ‘Armageddon’ and JobKeeper seemed rational and just.

Economic ‘Armageddon’ never arrived, yet billions in Jobkeeper were paid. And instead of payments going only to businesses in need, JobKeeper was paid to businesses for which coronavirus has been a boon. Shareholders and managers have profited from a scheme which the Business Council of Australia described as “fair and common-sense”, and which now appears to be neither of the two.

But in profiting from JobKeeper, have businesses done anything wrong?

Some people continue to argue that companies are obliged to maximise shareholder profit because they have a principal-agent duty to shareholders to do so (the shareholder primacy theory). But even so, there are constraints on what is allowed to be done by a company seeking to maximise profit. Nearly everyone agrees that companies should not break the law. It is not acceptable when a restaurant replaces mincemeat with sawdust in order to reduce costs. It is not permissible when a technology company increases revenue by spying on users. Beyond the law, however, most people also agree that companies have moral obligations to society.

Beyond the law, however, most people also agree that companies have moral obligations to society.

Even the individual most closely associated with ‘shareholder primacy’, Milton Friedman, argued profit-maximising companies should not only obey the law, but also must act in line with society’s ethical norms:

“There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits as long as it stays within the rules of the game, which is to say, engages in free and open competition without deception or fraud…conforming to the basic rules of society, both embodied in law and those embodied in ethical custom.”

As Friedman argues, these obligations should act as constraints on a company’s profit maximising motive. A company that orders an employee to drive past an accident on a remote freeway because rendering assistance doesn’t maximise profit, certainly fails our basic moral intuitions of what is acceptable.

To determine whether profitable companies ought to return their JobKeeper payments, we must determine whether companies have a moral obligation to do so. As the Federal Treasurer has made clear, companies have no legal obligation to return the funds. JobKeeper was intentionally designed by the Federal Government to impose minimal obligations on companies when receiving public funds – a position in stark contrast to the policy applying to individual citizens. It has been argued these minimal reciprocal obligations were essential to ensure the impediments to JobKeeper take-up were minimised.

If tax avoidance is “morally wrong”, as claimed by Gerry Harvey, so too is profiting from JobKeeper.

So, what of the moral obligation? Perhaps the best place to begin is by recognising that subsidies are simply a negative tax. So, if tax avoidance is “morally wrong”, as claimed by Gerry Harvey, so too is profiting from JobKeeper.

One way to argue the wrongness of tax avoidance (and by extension profiting from JobKeeper) is to consider Herbert Hart’s “principle of fairness”. The principle, in short, posits that those who benefit from the efforts of others have a moral obligation to reciprocate. The argument behind this principle is that when companies or individuals avoid tax, yet enjoy the public benefits provided by the State (the protections granted by the military; the law and order provided by the police and the judiciary; the well-educated citizenry; the functioning health-care system) they free-ride on the contributions of other taxpayers.

There are specific examples that illustrate this principle well. When James Hardie relocated its head office to Ireland, where the corporate tax rate is 12.5%, it is hard to see how this was making a fair contribution to Australia, where the majority of its shareholders reside. As Nick Kyrgios uses the Bahamas as his tax residence, where the personal tax rate is 0%, it is hard to see how this justly contributes to the nation which has not merely supported his career, but created the foundation for it. While donating to bushfire victims $200 per ace that he hit is meritorious, it does not offset tax avoidance because taxation is not charity. And in any case, making hundred-dollar donations is not equivalent to millions in avoided tax that did not fund the bushfire recovery.

Profiting from JobKeeper should be considered no different to tax avoidance. If companies who set up off-shore trusts to minimise their tax bill are considered free-riders on Australian society, so too should companies who unfairly profit from JobKeeper. These companies place the further profits of their shareholders ahead of alternate uses of taxpayer dollars. Ahead of more ventilators, more ICU beds and more nurses. And ahead of lower Government debt which will one day need to be repaid by the next generation of Australian taxpayers – the youth who are amongst the hardest hit by COVID lockdowns.

Personally, I find Hart’s principle of fairness has substantial force, as it seems most Australians do. But judging from the fact that many companies have refused to repay the profits they have generated from JobKeeper, it is clear that not everyone agrees. These companies and their shareholders are claiming they have a right to be held to a standard different to that which applies to everyone else in Australia. They claim they have a right to free-ride.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Health + Wellbeing, Science + Technology

Can robots solve our aged care crisis?

Opinion + Analysis

Business + Leadership

What are millennials looking for at work?

Opinion + Analysis

Business + Leadership

How ‘ordinary’ people became heroes during the bushfires

Opinion + Analysis

Business + Leadership

Survivor bias: Is hardship the only way to show dedication?

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Why we need land tax, explained by Monopoly

Why we need land tax, explained by Monopoly

Opinion + AnalysisBusiness + Leadership

BY Joshua Pearl 25 AUG 2021

Most people know the game Monopoly. But few are aware Monopoly was inspired by political economist Henry George’s warning against a dystopic society where land, water and minerals are owned by the dominant few.

To win in Monopoly, first you buy natural resources. Then you monopolise the land. Add some houses and hotels. And finally, force your adversaries into bankruptcy. In the game, it helps to be strategic, but mainly it helps to be lucky. Lucky to arrive first. Lucky to be able to hoover up the best land. In the end, lucky to crowd out the others, making them indigent losers.

Henry George was a brilliant self-taught 19th century American political economist. An advocate for free-trade and an opponent of protectionism, George is however best known for his criticism of the monopolisation of natural resources, arguing this both inhibits economic efficiency and is manifestly unfair. To achieve natural resource equality, George argued natural resources should be taxed at the level it would cost to rent the “unimproved” land. These taxes could be used to abolish other taxes (George’s position was to abolish all taxes except land tax), help fund government expenditure, such as the military, or redistribute in equal proportion to citizens.

Georgism is not an argument for material equality in any meaningful sense. Equal natural resource ownership is consistent with large levels of inequality when it comes to income and the ownership of non-natural assets. A Georgist might argue individuals own 100% of their labour income; that the industrious builder deserves his multiple houses (but not land), cars and boats, and that these are his alone; that the tech entrepreneur deserves her billions but has no right to buy up huge swathes of land. A Georgist position is consistent with minimal state intervention across welfare, education funding and paid parental leave.

The ideas of Henry George have garnered support from various quarters. Economist Joseph Stiglitz has argued Henry George’s proposal could fund the optimal supply of local public goods. Leader of the Chicago School of Economics Milton Friedman said, “in my opinion, the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago”.

One reason why equal natural resource ownership is preferable is because the alternatives are so underwhelming.

The alternatives of the ideological left, crudely speaking, have disastrous economic consequences. Under collective ownership, government ineptly decides what is produced from natural resources, undermining individual choice and failing to respect citizens. While under common ownership, people use natural resources whenever and however they choose, destroying the environment and economy, as predicted by the tragedy of the commons.

The alternative approaches of the ideological right, again crudely speaking, have their own problems. Primacy is given to first arrivals (though curiously, this line of argument is seldom extended to First Nations people), treating citizens unequally. Like Monopoly, first arrivals win, and second arrivals lose. These arguments typically rest on the ambiguous liberal Lockean proviso that “enough, and as good, left in common for others” or the harsher libertarian Nozickian argument that non-landowners need only pass a subsistence baseline living standard (essentially, non-landowners can eat and have water). But these claims ignore that natural resources are not made by anyone. And if no one has done anything to deserve the unimproved natural resources, and citizens of a country are equal, why are they granted such unequal rights over natural resources, the literal foundation of a country?

To Henry George, every citizen has an equal moral claim to the earth and without this, there is no equality among citizens.

In Australia, we are something of a Hasbro Monopoly ‘Special Edition’. Tech billionaires and their ilk hold some hundreds of millions worth of natural resources, while the mob from Broken Hill have somewhere closer to, and more likely very near, zero. Foreign investors such as Canadian pension funds and the Chinese Government own 14% of Australian agricultural land and 11% of Australian water assets.

Overall, Australian natural resources are worth more than seven trillion dollars (about 85% of which is land, driven by city land values), equating to around $300,000 per person. However, the bottom 20% of Australian households (typically younger folk, most likely regional or outer suburban people) have an average natural resource wealth of under $20,000 (and an average net wealth of around $25,000).

Yet there are reasons to be optimistic. The ACT is 10 years into their 20-year plan to abolish stamp duty and replace this with a land tax, providing instructive “dos” and “do nots” for other jurisdictions. And the NSW Government, with a coalition of support from real estate bodies, accountants, economists and community representative bodies, has proposed a land tax which sensibly considers a gradual introduction of land tax, ensuring fairness for those who have already paid stamp duty, although the proposal insensibly considers making land tax optional.

Overtime, a NSW land tax could be used to reduce other taxes, such as payroll tax, levied by the state government, or income tax, levied by the federal government. Reducing income taxes would reverse the peculiarity of the Australian tax system that we socialise the largely privately created wealth of labour, and privatise the naturally created wealth of natural resources.

Economists boast that a land tax boosts economic productivity, stimulates investment and increases efficiency, all neat reasons for a land tax. But the overwhelming case for an Australian land tax is fairness: that Australian dirt, water, ore and air, are owned by each Australian equally. The overwhelming case for a land tax in Australia is to ensure we don’t become a game of Monopoly.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

How to build a successful culture

Opinion + Analysis

Business + Leadership, Politics + Human Rights, Relationships

Tim Soutphommasane on free speech, nationalism and civil society

Opinion + Analysis

Business + Leadership

Why the future is workless

Opinion + Analysis

Business + Leadership

Our economy needs Australians to trust more. How should we do it?

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

Libertarianism and the limits of freedom

Libertarianism and the limits of freedom

Opinion + AnalysisPolitics + Human Rights

BY Joshua Pearl 20 JUL 2021

Libertarianism is the political philosophy that champions individual freedom. But does it really love freedom as much as it claims?

Governments interfere with our lives all the time. They punish us when we say things that they (or others) consider offensive. They make us save money we can only access if we reach a certain age. They engage police that can stop us in the street. They require us to inoculate against disease – even if it is against our wishes. And they demand we give away some of our salaries and assets (in the form of taxes), to be spent on things that may neither benefit nor be agreeable to us.

These are all fairly standard government interferences, even before we consider the more extreme restrictions that we have seen imposed throughout the COVID-19 pandemic.

Most political philosophies permit state interference, with some permitting quite a lot. Social contract theories, from Hobbes in the 17th century to Rawls in the 20th century, contend that citizens have consented either implicitly or explicitly, to give up certain freedoms, in exchange for protection of their remaining freedoms. However, not all political philosophies are as sanguine.

Libertarianism, which champions individual freedom, argues government interference is not only a pesky annoyance, but a violation of our fundamental rights. Libertarians contend that government interference is unjust even if intervention benefits the person being interfered with. Extreme libertarians would even support the right of a person to sell themselves into slavery – and would object to any government that seeks to prevent this.

Libertarianism has its roots in the works of the seventeenth and eighteenth-century liberal philosophers: John Locke, David Hume and Adam Smith. However, modern libertarians find much of their inspiration from Robert Nozick’s Anarchy, State and Utopia (1974). Nozick argues that individuals have strong self-ownership and property rights, rights that cannot be violated. Freedom, the core tenet of libertarianism, is the fundamental good to be affirmed and protected. On this view, we are all free (and equal) individuals, with the uninhibited right to make individual decisions with regard to our lives, our liberty, and the ownership of our property.

Libertarians, however are not anarchists. They do believe in the existence of the state. A libertarian state is one that performs the strictly limited roles of protecting citizens’ self-ownership and property rights and rectifying past transgressions of those rights.

Government’s role is to protect people’s freedom to choose happiness of a kind that is defined by each individual, not as dictated by others. If an individual wants to follow a particular god, that is their choice. If a person wants to buy a particular good or service on the free market, so let them. If a woman wants to marry multiple husbands, that is up to her.

For most right-libertarians, original property ownership (that is staking an ownership on unowned natural resources) is allowable, subject to the somewhat ambiguous Lockean proviso, that “enough and is good” is left for others. Nozick also asserted that when staking an ownership claim, no-one else should be made worse-off than they would otherwise be, which allows for significant variation in original property ownership. Left-libertarians, distinguished from right-libertarians by the very feature of original property ownership, claim everyone has a pro rata right to natural resources such as land, air and minerals.

Libertarianism’s absolute focus on individual freedom is attractive and makes for a consistent and simple political philosophy. It also has broad appeal, attracting strange ideological bedfellows.

Social progressives find attractive the social freedom associated with libertarianism. Governments have no right to punish an individual for taking recreational drugs; it is impermissible for the state to ban marriage between same sex couples; wrong for a country to wage a foreign war or conscript people into the army; and forbidden for government to ban, say, assisted dying.

Economic conservatives are attracted to the libertarian stance that it is wrong for government to take away assets in the form of an inheritance tax; impermissible for the state to impose an income tax for the purpose of redistribution. Indeed, the argument that government has no right to interfere in transactions between consenting adults, underpins the fundamental argument for many free market economists. Those on both the left and right are attracted to the argument that governments have no right to censor free speech.

However, if you think that libertarianism maximises freedom, then you would be wrong. One criticism of libertarianism is that it allows for scenarios which substantially limit freedom. Libertarianism prohibits anything but the very minimum level of taxation. This stance permits gross inequalities across wealth and income, and prohibits the levying of taxes required to fund the provision of state-run services.

As long as people are not interfered with, libertarianism finds it fair for children to be born into a subsistent existence, without access to education or basic healthcare. While these children may be able to do whatever they want without interference, their options and possibilities are severely limited. It is difficult to argue that these children are free in any meaningful sense.

Libertarianism also struggles to deal with negative externalities – the negative effects that individuals’ actions have on unrelated third parties. Companies (and individuals) tend to ignore costs which are imposed on other people. When this occurs, the net total cost to society of the pursuit of individual production and consumption choices, are typically negative.

Emblematic of this problem is climate change. I might enjoy all the benefits of taking a holiday to London, but I impose certain costs associated with green-house emissions that contribute to global warming, on other Australians. Adani’s shareholders and executives may enjoy the higher dividends and salaries from its pursuit of coal mining, but ignore the pollution costs they impose on future generations.

In such cases, libertarians, with their strong insistence of individual freedom, have very little constructive criticism to contribute to considerations regarding potential government intervention mechanisms. A further example concerns COVID-19 vaccination. Should citizens be free to choose whether they are vaccinated, despite the costs a failure to vaccinate imposes on other people? The libertarian position is that forcing someone to be vaccinated is unjust.

Perhaps the most incisive criticism of libertarianism though, is that paradoxically, libertarianism interferes too much.

Property acquisition typically involves a whole suite of historical injustices and the rectification of past injustice is likely to require a great deal of interference. If you are a card-carrying Silicon Valley billionaire libertarian, then you are aware (or at least you should be) that your worldly possessions are contingent upon the injustice of Europeans taking somebody else’s (native Americans’) private property.

Libertarian fairness, requires appropriate rectification. And arguing past injustices do not require rectification is arguing for something quite different to libertarian rules of justice. Most likely, that’s just arguing for self-interest.

Libertarianism has many attractive features and is likely to remain the political philosophy of choice for those who claim to love freedom. However, libertarian freedom is conditional. A world where libertarian rules of justice reign, may in fact result in a world that is not very free at all.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Politics + Human Rights

How we should treat refugees

Opinion + Analysis

Business + Leadership, Politics + Human Rights, Science + Technology

Not too late: regaining control of your data

Opinion + Analysis

Climate + Environment, Politics + Human Rights

Are we prepared for climate change and the next migrant crisis?

Opinion + Analysis

Business + Leadership, Politics + Human Rights

Hunger won’t end by donating food waste to charity

BY Joshua Pearl

Joshua Pearl is the head of Energy Transition at Iberdrola Australia. Josh has previously worked in government and political and corporate advisory. Josh studied economics and finance at the University of New South Wales and philosophy and economics at the London School of Economics.

It’s time to consider who loses when money comes cheap

It’s time to consider who loses when money comes cheap

Opinion + AnalysisBusiness + Leadership

BY Joshua Pearl 21 APR 2021

Monetary policy has yielded substantial social and economic benefits to modern economies.

Not least the achievement of low and predictable price stability. But to whose benefit?

It’s no secret that monetary policy increases the wealth inequality gap. That’s because it benefits those with assets, and by doing so it widens the chasm between the very rich and everyone else, making many Australians – in particular, the least financially secure – worse off.

While governments and central banks are openly aware of the inequalities these policies create, they have not taken measures to appropriately address the issue – the first step of which would be to update the RBA’s mandate.

Let me explain why. The Reserve Bank of Australia (RBA) has again announced that it’s kept the official cash rate on hold at 0.1 per cent, with the possibility it will remain thus until 2024. An RBA document released under a Freedom of Information request estimated that a permanent 1% cash rate reduction increases house prices by 30% over a three-year period.

For a middle-class family who own a $800k (median Australian) home, a 1% interest rate reduction increases their wealth by $240k. For the very rich who own a $100m portfolio of properties, their wealth increases by $30m, a windfall gain $29.76m greater than that of the middle-class.

For the one-third of Australians who do not own a home, not only does their net wealth remain unchanged, but the cost of entry becomes substantially higher. They are forced to work, save and pay more for essential assets such as housing, perpetuating the cycle and widening the gap.

The fiscal equivalent is government awarding a grant of $30m to people with $100m in assets; $240k to people with $800k in assets; and nothing to people without assets.

You don’t need to be an arch-communist to consider these outcomes unfair. However, the nature of the unfairness will depend upon the theory of justice invoked. For example, equality of outcome theory finds the unequal impacts of monetary policy unjust because Australians end up with different outcomes.

Alternatively, a Rawlsian theory of justice contends that social inequality is permissible only where the inequality benefits the least well-off to the greatest extent possible – a principle known as the difference principle. For a Rawlsian, existing monetary policies are unjust because there are alternate policies (including tax and transfer and direct cash transfer policies), that would be of greater benefit to the least well-off members of society.

The theory of justice I find most compelling is equality of opportunity. Like most theories of justice, equality of opportunity can be interpreted in different ways. What I have in mind is substantive equality of opportunity theory, which holds a fair society as one where individuals with the same level of talent and motivation, have the same prospects for success, regardless of their place in the social system.

Most Australians believe equality of opportunity is an important feature of our national ethos. Indeed, many Australian politicians cite equal opportunity as a key element of a just society (even if this rhetoric is not always followed with policy). Yet what we are seeing here is falling short of that ideal.

Monetary policy that penalises the least well-off and rewards people based on their starting level of wealth does not provide Australians with equal opportunity.

Indeed, justifying why the very rich deserve windfall gains is challenging unless one ascribes to the slightly perverse virtue theory that to have wealth is to deserve more wealth.

One solution is for government to tax and transfer windfall monetary policy gains. This policy might allocate an equal benefit to each Australian, or otherwise ensure each Australian has an equal opportunity to benefit.

While simple in theory, there are several practical shortcomings with this approach. One issue is measurement: for any asset value increase, determining the increase due to monetary policy versus other factors, such as asset improvements, is not straightforward. Another issue is timing: there is typically a substantial lag between monetary policy actions and asset value increases.

However, it seems to me, the most substantial issue is political pressure from vested interest groups. Taxing assets – regardless of whether people have earned those assets or the assets were merely granted to them through government policy – is eminently harder than simply not transferring windfall wealth in the first place.

Finding prevention, rather than jumping straight to the cure, has the added benefit of avoiding the unnecessary social antagonism that occurs when creating groups of “us” (the “lifters” who are taxed) and “them” (the “leaners” who receive).

A preventative solution can be found in updating the RBA’s mandate, a change that might take on various degrees. The more substantiative update would be to require all future monetary policy to produce no negative impact on wealth inequality. This would make some existing policies unviable or mean that if pursued they must be coupled with additional mechanisms that even up the ledger for the middle and lower classes.

A middle ground alternative might merely begin by requiring the RBA to consider unfair wealth impacts as tiebreakers. For example, when all other features of opposing policy are equal, that which provides all Australians equal opportunity to benefit would be considered preferential. This mandate should require the RBA to consider various options and justify those adopted on the principle of fairness, relative to the alternatives that were overlooked.

Reserve Bank Governor, Dr Philips Lowe recently stated that the responsibility for controlling asset prices is not that of the RBA: “That’s not our mandate. I don’t think it’s sensible and I don’t think it’s even possible”.

That the RBA cannot and does not control asset prices is similar to the fact that the RBA cannot and does not control the social phenomenon of inflation.

Yet the RBA can and does influence asset prices, simply look at the ripple effect of the 0.1% cash rate. The RBA can and does also target asset prices, noting the RBA bond-buying programs which are designed to prop up bond prices. To suggest otherwise is misleading.

Like any other public institution, the RBA is accountable to those they serve – the general public – not to their own ends. And the Australian public may want a little more rigour in that accountability than, ‘that’s not our mandate’ when dismissing the policy options put forth by economists such as Milton Friedman, Frederic Mishkin and Patrick Honohan.

It might be true that alternative policy options such as cash transfers through the budget (where the central bank issues money directly to the government who distribute it) or direct cash transfers (where the central bank issues money directly) are unworkable.

However, allowing the RBA to dismiss their policies’ negative effects because their mandate does not require this consideration, is not something Australians should consider acceptable.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Doing good for the right reasons: AMP Capital’s ethical foundations

Opinion + Analysis

Business + Leadership

Who are corporations willing to sacrifice in order to retain their reputation?

Opinion + Analysis

Business + Leadership, Relationships

It’s time to take citizenship seriously again

Opinion + Analysis

Business + Leadership