This tool will help you make good decisions

This tool will help you make good decisions

Opinion + AnalysisBusiness + Leadership

BY The Ethics Alliance 13 AUG 2018

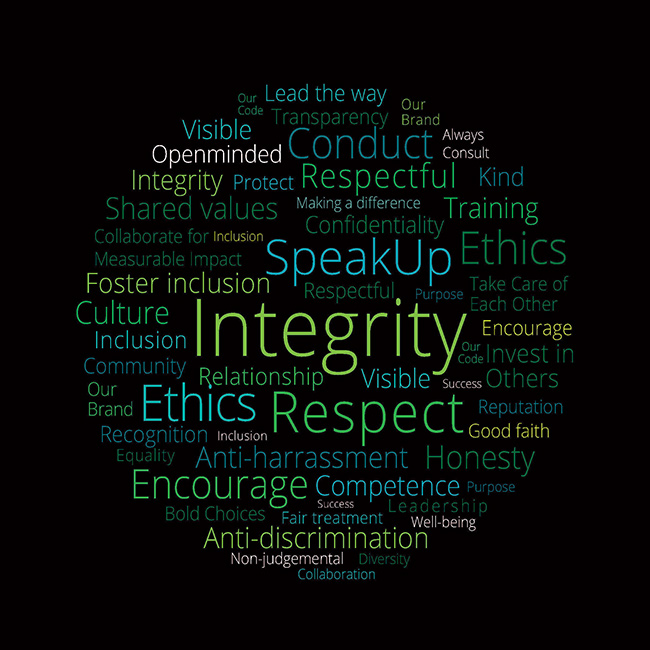

The Ethics Centre has developed an online Quality Decision Making tool, due to be launched to Ethics Alliance members by the end of this year, to guide and support quality decision making for any member of an organisation.

Co-head of advice and education, John Neil, explains how the tool will help you in your business:

1. What is the Quality Decision Making tool?

The online platform guides users through a framework for ethical decision making, especially when those decisions are challenging and difficult. It provides personal insight, knowledge, awareness, case studies, tips, and hacks.

Ethics Alliance members are invited to be part of the testing and refining of the platform before its full roll out in November. Funded by The Ethics Centre, it has been custom designed for our corporate Alliance members and will be made available to all employees of Alliance members.

2. What kind of decisions can the tool tackle?

The platform is designed for difficult decisions – personal or professional – where there is no clear right or wrong answer. It will help discern:

• What is important

• What is at stake

• What matters most

• Who is involved

• Impacts and implications

• Possible options

• How to evaluate options

• What principles might apply to assess options

While helping solve a specific dilemma, the platform helps users develop core decision making capabilities, such as intention, context mapping, judgement, bias minimisation, root cause analysis, innovation, communication, wisdom, and courage.

3. What is the process like?

It takes about 45 minutes for first time users and, after that, return users will spend around 10 to 20 minutes on specific decision making challenges.

4. What is unique about this platform?

There are a number of decision making tools on the market, ranging from apps to analogue models, however the Quality Decision Making Platform is the first of its kind to combine skills development with help to make specific decisions.

5. Can you give me a scenario where it would help?

Troublesome rainmaker: You are a line manager in the finance sector. One of your key staff is excellent at her job and generates a lot of income for the company – no other team member comes close to her results. She has rejected overtures from competitor companies, much to your relief because your department is heavily reliant upon her abilities and your bonuses depend on your department’s profitability. Unfortunately, she has also been reported to HR and you about repeated inappropriate behaviour. What should you do?

Disaster warning: You work for the director of human resources and have access to confidential information about a coming restructure, including the names of those about to be made redundant.

At lunch, a colleague mentions her boss is about to take on a heavy debt to buy a new house, in preparation for the birth of his third child. You know that man is about to be made redundant. What should you do?

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Money talks: The case for wage transparency

Opinion + Analysis

Business + Leadership, Relationships

There are ethical ways to live with the thrill of gambling

Reports

Business + Leadership

Thought Leadership: Ethics in Procurement

Opinion + Analysis

Health + Wellbeing, Business + Leadership

The ethical dilemma of the 4-day work week

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

Banks now have an incentive to change

Banks now have an incentive to change

Opinion + AnalysisBusiness + Leadership

BY The Ethics Alliance 13 AUG 2018

Pay for performance has earned itself a nasty reputation. During shocking revelations from the Hayne Royal Commission, bonuses and commissions linked to sales volumes have been blamed for driving all sorts of unethical and criminal behaviour.

To meet targets and get their bonuses and commissions, employees have charged fees for no service, inappropriately opened bank accounts for children, accepted bribes to approve mortgages, forged signatures, and sold people into loans and investments they could not afford.

All this was foreseeable. The conflicts of interest in tying financial rewards to sales targets have been well researched and documented over the past 50 years.

Yet, corporate leaders chose to stick with a system that rewards people for the volume they sell – sometimes even prioritising the riskier and more profitable investments – rather than the quality of the service they offer.

During the Royal Commission hearings, some banks pledged to remove “conflicted commissions” for their financial planners and restructure incentives for other staff, such as call centre workers. However, they have not always been receptive to the news that their rewards programs may be driving unethical behaviours.

Shaun McCarthy is an authority on organisational culture and chair of consultancy Human Synergistics. He says banks have given him short shrift in the past when he has warned about the conflicts of interest inherent in their incentive programs.

“I can talk to them until I am blue in the face about the unintended consequences but, if revenue is going up and profit is going up, they are not interested”, he says.

“They basically tell me to bugger off because they think their current success is a consequence of [their structures and processes]”, he says. “It is a misattribution of success.”

McCarthy says financial rewards for performance have a place in business, but they must balance with goals for customer service, feedback, repeat business, relationship management and other factors.

Human Synergistics’ research shows 32 variables influence organisational culture – and goalsetting comprises only four of them.

“They have to look at how people are managed through the entire system of the organisation to change the culture – not just get rid of the sales goals or whatever it might be”, says McCarthy.

“I have had banks tell me over the years that they need to have those aggressive cultures to compete in the marketplace, which means they simply do not understand the process – and they are learning it the hard way now”, he says, referring to the Banking Royal Commission.

Corporate leaders are often loath to change their incentive programs for fear star performers will leave and profits will suffer.

McCarthy urges them to hold their nerve. “The reward will be in the long term. You don’t necessarily have to get rid of the incentives, you don’t need to get rid of the goals, you just need to change what they are and how they are managed.”

Jon Williams has 30 years of experience helping businesses connect their people to their business results and has seen first-hand what can happen when individual rewards for performance are scrapped in favour of group rewards.

In his case, the result was an improvement in collaborative behaviour, without damage to business growth. Williams recently left professional services firm PwC, where he was global leader of people and organisation, to launch his consultancy, Fifth Frame.

A few years ago, when integrating two teams into one team of 20 executives, Williams decided to spread the bonus pool equally across all team members, regardless of individual performances.

“I knew that having them effectively compete for bonuses would drive behaviour counter to the aim of creating one new collaborating team.” – Jon Williams

Previously, only 30 percent of those executives – the highest performers – were offered bonuses, funded through the success of the business.

Under the new structure, the highest performers would earn a smaller bonus, while the remaining 70 percent of the team were awarded a share of the bonus pool for the first time.

The business performed well, providing an attractive bonus to all members. However, three months before the end of the financial year, one of the executives explained his results had not been strong, and it would be okay if he received no bonus that year.

“He was treating the relationship with the organisation and his team as a financial one”, says Williams, whose reply was, “No, you are in the team and you’ll get the same bonus as everyone else, and you need to be able look your colleagues in the eye and know you tried your best to deserve it’.”

“Instead of dropping off for the rest of the year, he redoubled his efforts”, says Williams.

“His team’s numbers didn’t actually get any better, but they threw his and their efforts into helping others who were busy and needed support.

“We had retained the incentives to make sure the team was paid fairly for their performance, but we had managed to maintain a social contract between the execs and each other and the company which resulted in better corporate behaviours and performance”, says Williams.

There are other motivations, apart from money, for doing good work, says Williams. Pride, ego, work ethic, long term aspirations, and competitive drive are some of them.

The vast majority of the Australian working population get themselves to work and perform their duties without being offered an extra incentive above their fixed salary.

Behavioural strategist Warren Kennaugh says employers need to accept that not everyone is motivated by money.

“Extrinsic motivators, such as money, aren’t as powerful as intrinsic motivators [such as pride].” – Warren Kennaugh

CEOs are often commercially oriented and believe that everyone else is too. “It is a problem that gets us into trouble because it sets simplistic behaviours”, says Kennaugh, who works with corporate leaders and elite athletes.

Using money as a reward can even make an enjoyable job feel like a chore, according to a meta-analysis of 128 controlled experiments by US Psychology professor Edward Deci and colleagues.

For every increase in reward, intrinsic motivation for interesting tasks declines by 25 percent and, when subjects know in advance how much extra money they will receive, intrinsic motivation decreases by 36 percent. (There is an argument that monetary rewards can increase motivation for boring tasks.)

“[Financial incentives] reduced creativity, diminished results, foster bad behaviour, inhibit good behaviour, and cost the business more to maintain,” says Kennaugh.

McCarthy says a badly structured incentives program will set employees against each other into a competition for the “prize money”.

“Because the message they take away from that [structure] is that it is not so much how you perform, but how you compare that counts.

“So now, people are focused on a competition, which requires people to win and lose.” You achieve the goal to win and create losers by not sharing information with them, he says.

Kennaugh says efforts to restructure incentive programs have to meet the “fairness test”.

A 2012 global study by PwC and the London School of Economics and Political Science finds “… executives are content as long as they are paid what they consider to be ‘fair’ within the hierarchy of their own company, and comparably against those on a similar level in competitor companies, to the extent that it almost becomes irrelevant how much they are paid”.

Employees will punish employers if they feel short changed, says Kennaugh.

“When it is review or bonus time, I am reflecting on every Sunday night that I left home to fly somewhere, every birthday party I didn’t get to, every State of Origin game I didn’t get to see and I’m not sure I have got a figure, but I have an emotional amount that, in my mind, that is what it has all been worth.

“The moment that I am not [paid fairly], I will go on some form of private strike”, he says. “And the dilemma of organisations is that they don’t own the fairness test.”

When the New Jersey police force won less than officers wanted in salary negotiations, arrest rates and average sentence length declined – indicating that police were putting in less discretionary effort.

“For a period of about 18 months after collective bargaining, the cops went on strike”, says Kennaugh.

This is a warning that employers must tread carefully when restructuring their financial incentive programs – especially when some people will be disadvantaged by those changes.

Employers should try to implement the changes in stages and think about how to deal with the fallout.

“I’d be concerned about the implications about how people are likely to manage it and retaliate. If I’ve been getting it and [I feel] it is an earned right, what are you going to give me to compensate?”

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Perils of an unforgiving workplace

Opinion + Analysis

Business + Leadership, Climate + Environment, Relationships

ESG is not just about ticking boxes, it’s about earning the public’s trust

Opinion + Analysis

Business + Leadership

Is debt learnt behaviour?

Opinion + Analysis

Business + Leadership, Health + Wellbeing

Tips on how to find meaningful work

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

The Royal Commission has forced us to ask, what is business good for?

The Royal Commission has forced us to ask, what is business good for?

Opinion + AnalysisBusiness + Leadership

BY The Ethics Alliance The Ethics Centre 13 AUG 2018

AMP Capital was applauded last year when it committed to selling $600 million worth of shares that did not meet its ethical guidelines. However, barely a year after announcing it was getting rid of its direct and indirect interests in tobacco and landmines, AMP was itself ejected into a basket of “untouchables”.

Australian Ethical announced in May it was divesting itself of AMP shares in the wake of searing revelations from the Financial Services Royal Commission.

Billions of dollars were wiped from the value of AMP after the public and investors discovered the wealth manager charged “fees for no service” and steered people into investments that rewarded their financial planners, at the expense of the clients.

Head of ethics research at Australian Ethical, Dr Stuart Palmer, says there were a number of reasons behind the decision to divest, “… but specifically, a senior decision made within the financial planning business to charge clients fees for services they weren’t receiving. They knew it was wrong, they knew it was illegal.

“There were people in the business saying we need to stop doing this, and they kept doing it at a senior level”, he says.

The Royal Commission into Financial Services has been exposing the rot eating away at some of our biggest and most powerful corporations and has reenergised an ongoing debate about what is the actual purpose of business and who it serves.

Palmer says legal cases in the US established shareholder primacy a century ago, with the primary responsibility of business interpreted as creating profits for shareholders.

“Since then, and before then, there has been a debate about whether that is right, whether there are other ways of thinking about corporations having independent interests and responsibilities to all their stakeholders, including shareholders, but also employees, customers, suppliers and society”, says Palmer.

“None is necessarily dominant over the others, but they need to be balanced in the interests of all.”

This discussion about the role of the corporation is being weighed up at all levels, including by the chairman of NAB, Ken Henry, who delivered a speech in March saying that it was not enough for companies to use the “pursuit of profit” to explain away their contribution to negative consequences, such as greenhouse gas emissions and other forms of pollution.

“If that’s the best we can do, then we shouldn’t wonder that we find it so difficult to occupy positions of trust and respect in society. Neither should we wonder that politicians of all political colours have such an uneasy relationship with us”, he told a gathering of the Australian Institute of Company Directors.

This was a debate that the Commonwealth Bank non-executive director, Harrison Young, was alluding to when he wrote last year, “banks should not be profit-maximising institutions. They have duties to the community that oblige them to forego a certain amount of upside”.

Judith Fox, the CEO of the Australian Shareholders Association, says she is aware of increasing numbers of companies and boards having this discussion.

“I’m seeing a lot of conversations that ultimately are all about how something needs to change in the way we operate”, she says.

“I think we are one of those transition periods where there has been a social norm that the purpose of a company is shareholder return and that has been accepted in markets worldwide for four decades”, she says, adding the realisation that companies should stand for more than just profits may come as a surprise to people whose knowledge of economics does not extend further back than US economist Milton Friedman’s pronouncement in 1962 that there is only one social responsibility of business and that is to make money.

Friedman wrote in Capitalism and Freedom:

“There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.”

Fox says the current debate about the role of the corporation is a return to the concept, popular in the 1930s – that business had a social role to play as well.

Professor of Human Rights Law at Sydney University, David Kinley, agrees that many people’s attitudes are formed by what they have experienced in the past 20 years.

“It is what they have seen since the 80s, which has been a long – until 2008 [the start of the Global Financial crisis] – largely uninterrupted boom period.”

Kinley says Scottish economist and philosopher Adam Smith would be horrified to see the societal cost of rampant free marketeers.

Smith had written in The Wealth of Nations, nearly 250 years ago:

“… that individual acts of economic self-interest combine, through the ‘invisible hand’ of market forces, to further the best interests of society at large”.

Says Kinley, “So, he certainly would be turning in his grave to see all this wealth, so much of it is now concentrated in the hands of the few. Yes, we are better off than we were 200 years ago. Unquestionably. But by God, it’s been at a big cost to the notions of equity and fairness.

“And [investor] Warren Buffett says often – and he is the second richest man in the world – he said he is amazed there are not more people with pitchforks heading for the rich like him because he can’t see how they don’t appreciate this appalling inequality.”

Kinley, author of Necessary Evil: How to Fix Finance by Saving Human Rights, says he is not advocating some sort of Socialist revolution, but remaking the “financial, commercial, corporate neoliberal system that we now have one that works better for people as a whole”.

“If you don’t do that, you have a bubbling up of disquiet, of resentment, that no matter what happens – even things like the global financial crisis – the rich, the powerful, the banking, the financial system, they sail through it, on the back of public funds that bailed them out because they had to be saved. When people ordinary people look at that, they say, ‘How is that fair?’.

“So you get the reaction of, ‘Well, let’s vote in somebody who is willing to drain the swamp, you know, shake up the area and I don’t care if he’s mad or narcissistic or a nincompoop. You put him in there in the White House and just see what happens.’

“These sorts of reactions are almost desperation. I don’t think they are logical, I don’t think they are at all laudable, but you see why people are doing it.”

While there is evidence ethical investments outperform the average large-cap Australian share funds over three, five and 10 year time horizons, Kinley maintains corporations and their executives should be ethical because it is the right thing to do, not because it might make them money.

“What I would suggest what all of us want to do in the morning, truly, is to stand in front of the mirror as you’re brushing your teeth and say, ‘I’m proud of what I do or at least I can see why I do what I do and it is something that is worthwhile’.

“You don’t want to look in the mirror and think, ‘Oh I’m making a lot of dosh, but Geez it is dodgy’.”

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Science + Technology

Is it ok to use data for good?

WATCH

Business + Leadership

The thorny ethics of corporate sponsorships

Opinion + Analysis

Business + Leadership, Politics + Human Rights

Why fairness is integral to tax policy

Opinion + Analysis

Business + Leadership

The near and far enemies of organisational culture

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Is it ok to use data for good?

Is it ok to use data for good?

Opinion + AnalysisBusiness + LeadershipScience + Technology

BY Adam Piovarchy The Ethics Centre 7 MAY 2018

You are nudged when your power bill says most people in your neighbourhood pay on time. When your traffic fine spells out exactly how the speed limits are set, you are nudged again.

And, if you strap on a Fitbit or set your watch forward by five minutes so you don’t miss your morning bus, you are nudging yourself.

“Nudging” is what people, businesses, and governments do to encourage us to make choices that are in our own best interests. It is the application of behavioural science, political theory and economics and often involves redesigning the communications and systems around us to take into account human biases and motivations – so that doing the “right thing” occurs by default.

The UK, for example, is considering encouraging organ donation by changing its system of consent to an “opt out”. This means when people die, their organs could be available for harvest, unless they have explicitly refused permission.

Governments around the world are using their own “nudge units” to improve the effectiveness of programs, without having to resort to a “carrot and stick” approach of expensive incentives or heavier penalties. Successes include raising tax collection, reducing speeding, cutting hospital waiting times, and maintaining children’s motivation at school.

Despite the wins, critics ask if manipulating people’s behaviour in this way is unethical. Answering this question depends on the definition of nudging, who is doing it, if you agree with their perception of the “right thing” and whether it is a benevolent intervention.

Harvard law professor Cass Sunstein (who co-wrote the influential book Nudge with Nobel prize winner and economist Professor Richard Thaler) lays out the arguments in a paper about misconceptions.

Sunstein writes in the abstract:

“Some people believe that nudges are an insult to human agency; that nudges are based on excessive trust in government; that nudges are covert; that nudges are manipulative; that nudges exploit behavioural biases; that nudges depend on a belief that human beings are irrational; and that nudges work only at the margins and cannot accomplish much.

These are misconceptions. Nudges always respect, and often promote, human agency; because nudges insist on preserving freedom of choice, they do not put excessive trust in government; nudges are generally transparent rather than covert or forms of manipulation; many nudges are educative, and even when they are not, they tend to make life simpler and more navigable; and some nudges have quite large impacts.”

However, not all of those using the psychology of nudging have Sunstein’s high principles.

Thaler, one of the founders of behavioural economics, has “called out” some organisations that have not taken to heart his “nudge for good” motto. In one article, he highlights The Times newspaper free subscription, which required 15 days notice and a phone call to Britain in business hours to cancel an automatic transfer to a paid subscription.

“…that deal qualifies as a nudge that violates all three of my guiding principles: The offer was misleading, not transparent; opting out was cumbersome; and the entire package did not seem to be in the best interest of a potential subscriber, as opposed to the publisher”, wrote Thaler in The New York Times in 2015.

“Nudging for evil”, as he calls it, may involve retailers requiring buyers to opt out of paying for insurance they don’t need or supermarkets putting lollies at toddler eye height.

Thaler and Sunstein’s book inspired the British Government to set up a “nudge unit” in 2010. A social purpose company, the Behavioural Insights Team (BIT), was spun out of that unit and is now is working internationally, mostly in the public sector. In Australia, it is working with the State Governments of Victoria, New South Wales, Western Australia, Tasmania, and South Australia. There is also an office in Wellington, New Zealand.

BIT is jointly owned by the UK Government, Nesta (the innovation charity), and its employees.

Projects in Australia include:

Increasing flexible working: Changing the default core working hours in online calendars to encourage people to arrive at work outside peak hours. With other measures, this raised flexible working in a NSW government department by seven percentage points.

Reducing domestic violence: Simplifying court forms and sending SMS reminders to defendants to increase court attendance rates.

Supporting the ethical development of teenagers: Partnering with the Vincent Fairfax Foundation to design and deliver a program of work that will encourage better online behaviour in young people.

Senior advisor in the Sydney BIT office, Edward Bradon, says there are a number of ethical tests that projects have to pass before BIT agrees to work on them.

“The first question we ask is, is this thing we are trying to nudge in a person’s own long term interests? We try to make sure it always is. We work exclusively on social impact questions.”

Braden says there have been “a dozen” situations where the benefit has been unclear and BIT has “shied away” from accepting the project.

BIT also has an external ethics advisor and publishes regular reports on the results of its research trials. While it has done some work in the corporate and NGO (non-government organisation) sectors, the majority of BIT’s work is in partnership with governments.

Braden says that nudges do not have to be covert to be effective and that education alone is not enough to get people to do the right thing. Even expert ethicists will still make the wrong choices.

Research into the library habits of ethics professors shows they are just as likely to fail to return a book as professors from other disciplines. “It is sort of depressing in one sense”, Braden says.

If you want to hear more behavioural insights please join the Ethics Alliance events in either Brisbane, Sydney or Melbourne. Alliance members’ registrations are free.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Power play: How the big guys are making you wait for your money

Opinion + Analysis

Health + Wellbeing, Relationships, Science + Technology

Hallucinations that help: Psychedelics, psychiatry, and freedom from the self

Opinion + Analysis

Business + Leadership

Why you should care about where you keep your money

Opinion + Analysis

Relationships, Science + Technology

If humans bully robots there will be dire consequences

BY Adam Piovarchy

Adam Piovarchy is a PhD candidate in Moral Psychology and Philosophy at the University of Sydney.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

6 Myths about diversity for employers to watch

6 Myths about diversity for employers to watch

Opinion + AnalysisBusiness + Leadership

BY The Ethics Alliance The Ethics Centre 7 MAY 2018

Employers can play a role in countering backlash attitudes to gender equality by making the case for why it is good for employees and good for the organisation.

Sociologist, Dr Michael Flood, says much of the opposition to diversity programs is based on misunderstandings, such as the following common myths:

If women win, men lose.

“There is a misperception that it is a zero sum game – that any gains for women at work necessarily involve losses for men”, he says.

Men’s own wellbeing is limited by narrow ideas about how they are “supposed” to behave, argues Flood in the recently released Men Make A Difference report, co-authored by diversity and inclusion researcher Dr Graeme Russell for the Diversity Council of Australia.

Men often pay heavy costs – in the form of shallow relationships, poor health, and early death – for conformity with narrow definitions of masculinity, according to the report.

There is a level playing field.

“Some men may also be under the misapprehension that the current system is already fair and the initiatives are unnecessary and unfairly advantage women”, says Flood.

“The current system is not and has not been fair. It has disadvantaged women and initiatives, such as affirmative action, make the system fairer. They give women and men the same opportunities.”

The national gender pay gap is 15.3 percent, with women earning on average, $253.70 a week less than men, according to the Workplace Gender Equality Agency. This disadvantage starts as soon as they graduate: women earn less than men in 17 out of 19 fields of study and across nine out of 13 industries.

Flood says a neoliberalist ideology holds that women can make it on their own and achievement is a matter of individual skill and effort and that social interventions are unnecessary, if not intrusive.

“There is also a widespread perception that gender inequality is a thing of the past. Therefore, if women are doing less well at work, then it is simply down to their own choices or their own fault”, he says.

“Those widespread beliefs also constrain our efforts to build gender equality.”

Some jobs are now women only.

Flood says that it is against the law to refuse to hire men and he does not believe this is happening systematically.

“If this were going on systematically then we might expect to find the numbers of women in Australian corporate boardrooms increasing and, in fact, in the last decade, it has decreased. A mere 16.5 percent of Australian CEOs or heads of business are women.

There are exemptions under discrimination law to allow special and positive measures to improve equality.

Men are being discriminated against.

Certainly, there are men who are facing more competition for jobs in areas where women are making gains, especially where employers are actively trying to recruit and promote more women to even up the gender balance.

Around 12 percent of men believe women are treated better than men, compared with 3 percent of women who believe the same, according the University of Sydney research.

However, Flood says he thinks it is wrong to assume men in that situation will miss out in favour in women who are weaker candidates.

“It may well happen that women are promoted above men who are worthy candidates but, in general, that is not the case. There is a different kind of fear, which is that he will now be judged equally against female candidates who have the same skills on their CV as him.”

“For some men, when they are used to privilege, they are used to advantage, then equality looks like discrimination.”

Flood says there are hundreds of studies that show that CVs with female names are judged more harshly by recruiters than those with male names.

We hire and promote on merit.

Flood says this is a simplistic argument against diversity programs and can be countered by pointing out the ways merit can be subjective and biased.

“We need to talk about actual merit and perceived merit.”

It is a women’s issue.

Flood says that men are also disadvantaged by inequality. Shorter men, for instance, find it harder to progress.

“Male CEOs, on average, are four or five centimetres taller. That is not because tall people are more competent, it is because they are perceived to be more competent and more appropriate leaders. So implicit and unconscious stereotypes shape who gets promoted.”

The quality of every man’s life depends to a large extent on the quality of those relationships with the women in their lives. “Men gain when the women and girls around them have lives which are safe and fair”, says Flood.

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

The dangers of being overworked and stressed out

Opinion + Analysis

Business + Leadership, Relationships, Society + Culture

Extending the education pathway

Opinion + Analysis

Business + Leadership

Managing corporate culture

Opinion + Analysis

Business + Leadership

What are millennials looking for at work?

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Power play: How the big guys are making you wait for your money

Power play: How the big guys are making you wait for your money

Opinion + AnalysisBusiness + Leadership

BY The Ethics Centre 3 MAY 2018

The CEO was brutally honest in revealing how his multinational company uses its power to delay payment to its small suppliers. Unless there are laws to make them pay up earlier, small companies are forced to wait four months for their money, he said.

The business leader was explaining the policy of his overseas head office to Kate Carnell, the Australian Small Business and Family Enterprise Ombudsman, during her inquiry into late payments last year.

“I must admit I was just horrified”, says Carnell, who says a 30 day wait is acceptable business practise.

The CEO of the Australian arm of the multinational company said payment times were pushed out to 120 days. Says Carnell: “One guy [attending the inquiry] laughed and said, ‘You should consider yourself lucky, we have a 365 day payment contract in one country I know about’.”

“They said, ‘If there is nothing that makes us pay shorter, then we will pay longer. That is just the way we operate’.”

Carnell’s Inquiry into Payment Times and Practices uncovered a widespread exercise where big organisations are using small to medium sized suppliers as a cheap form of finance. By paying invoices months after products and services are delivered, large companies can improve the efficiency of their own working capital but, in doing so, starve their vulnerable small business operators of cash.

About half of the small to medium sized businesses surveyed by the inquiry say around 40 percent of invoices were paid late. According to Carnell, 90 percent of small businesses go broke because of cash flow issues and many try to tide themselves over with credit card debt and overdrafts.

Australia had the dubious honour of being the worst performer in global research on late payments by MarketInvoice in 2015, with settlement taking place an average 26.4 days after it was due.

Lending you the money they owe you

In a further development, interest bearing loans are being offered to suppliers who are waiting to get paid. Carnell has named Mars, Kellogg’s and Fonterra as three large companies offering this kind of supply chain finance.

These loans effectively levy a discount (the interest paid) on suppliers who cannot afford contractual waits of 120 days or more. “It’s pretty close to extortion really”, Carnell told the Sydney Morning Herald last year.

Another practise is to demand a discount from suppliers who want to be paid earlier than the contracted period – even though that period may be outside what is regarded as acceptable.

“There are two ways to do it. One is to require a discount, the other is to lend you the money at an interest – both of them are unacceptable”, says Carnell.

“You’ve got what is the essence of what could be regarded bullying, it is certainly using market power in an oppressive manner.”

Salt’s call for ‘same day pay’

Social commentator Bernard Salt recently called for “same day pay” in a column in The Australian newspaper, arguing that companies should not be buying products and services if they cannot pay for them straight away.

“There are 1.5 million small businesses in Australia. If you add in their partners, and staff and kids, then you are probably looking at four to five million people in Australia that are affected by timelines or otherwise of small business payments”, he says.

“The best thing you can do for small business is to pay promptly, on the day, same day pay. If you can’t pay for it, don’t buy the good or service.

“Refusing to pay in a timely and reasonable and fair manner is the equivalent of theft. I just cannot understand where people believe it is good or smart business practise. People might think it is smart, I think it is smarmy. If you incur a debt, you pay it and pay it promptly.”

Salt says he sees no reason why the flow of money is restricted to business hours, five days a week, when the rest of the world is operating 24/7.

“We should expect money to flow at the speed of data.”

Carnell says she is not demanding immediate payment … for now. “At some stage in the future, we think that is the way it should be. Right now, 30 days or less is reasonable”, she says.

Voluntary codes don’t work

To encourage best practise, Carnell’s office has set up the voluntary Small Business Ombudsman’s National Transparency Register. So far, around 21 organisations have agreed to report on their progress on paying promptly.

“It is a start, but it is a drop in the ocean really”, admits Carnell.

The Business Council of Australia responded to the inquiry by introducing its own voluntary Australian Supplier Payment Code, which commits signatories to 30 day payment times to small businesses and has around 77 signatories, but it has no requirement that companies report.

The NSW Small Business Commissioner, Robyn Hobbs, recently told ABC Radio that she does not think the BCA code goes far enough. “These things should be mandatory”, she said.

Carnell says her approach is to try a voluntary approach first, but admits she has little faith it will work.

“We looked around the world … and we hadn’t found a situation where a voluntary code had worked to create systemic change. The problem with voluntary codes is that the good corporate citizens sign them.”

People who think their own cash flow is more important than the economy won’t sign, she says.

“We would love a voluntary code to work because it would show that, as a nation, we do take good business practise, ethical behaviour, really seriously and we can make these things work without legislation. We will review it in 12 months and we would expect, if it had not been successful, that a Government would legislate.”

Governments set a standard

In the UK, the Government has introduced a voluntary Prompt Payment Code, working towards 30 day payment, and there is legislation requiring large businesses to publish details publicly of their actual payment times.

Governments can provide a good example to the commercial sector. A UK Central Government Prompt Payment policy seeks to pay 80 per cent of undisputed and valid invoices within five days.

The European Union has a Late Payment Directive setting a maximum payment time of 60 days, or 30 days for government, with an interest penalty, and ability to claim compensation and recovery costs. US government has QuickPay to reduce government payment times from 30 days to 15 days.

In Australia, Federal Government agencies have committed to paying small operators in 15 business days by mid 2019.

Some individual companies have also taken up the challenge since the inquiry, which reported a year ago. Since the inquiry, Mars has moved from 120 day payment terms to 30 days for small businesses. “That is a big step”, says Carnell.

Telstra has also “made a big effort”, reducing payment times from 45 days or longer down to 30 days or fewer for all its 7366 small business suppliers. The telco spends around $2.9 billion each year with small business suppliers.

“Those are the ones I know that have actually had to go through quite a lot of hassle to change their systems, it wasn’t a simple flick of the switch. The banks tell us they have moved to 30 days or less”, she says.

Woolworths and Coles have committed to paying small suppliers within 14 days.

“Some good things are happening, but it’s not enough, not nearly enough”, says Carnell.

Boards do not know if they are slow payers

Carnell has been in discussions with the Australian Institute of Company Directors about making payment times reporting a standard agenda item for board meetings.

“My experience as both a CEO and a board member, is that focusing the board’s mind on these sorts of things makes a big difference to corporate culture. Our experience, when talking to board members, is they have no idea how their company is operating in terms of payment times.”

A spokesman for the AICD says the organisation is promoting the code and the views of the Ombudsman to its members but cannot control what boards put on their agenda.

One entrepreneur has decided to take matters into her own hands, launching a “name and shame” platform for small business operators.

Frances Short launched the Late Payer List in March so that small to medium sized businesses could check the reputations of buyers or report cases where clients were too tardy or refusing to pay on invoices where there was no dispute about the work or products.

Short says she came up with the idea after watching her partner, a builder, continually have to chase payment, sometimes resorting to legal action.

Once when one client kept dodging a large payment, Short’s partner tried some social shaming. “He said to this guy, ‘I’m going to come down to your church wearing a sandwich board, telling your neighbours that you owe money and it’s not fair’.” The customer paid up.

“We want to do something for small biz that was much simpler, something that was socially powered and giving control back to small business owners, without the need for using expensive debt collectors or lawyers”, she says.

“What we have got is a bit of a nudge, nudge for late payers, so there is a consequence.”

The Ethics Alliance collaborated with members on a new procurement research paper for making ethical payment easy. Download your copy here.

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

How cost cutting can come back to bite you

Opinion + Analysis

Business + Leadership

Pulling the plug: an ethical decision for businesses as well as hospitals

Opinion + Analysis

Business + Leadership

In the court of public opinion, consistency matters most

Opinion + Analysis

Science + Technology, Business + Leadership

Ask an ethicist: Should I use AI for work?

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Is employee surveillance creepy or clever?

Is employee surveillance creepy or clever?

Opinion + AnalysisBusiness + Leadership

BY The Ethics Alliance The Ethics Centre 1 MAY 2018

A large European bank tracks its employees in work hours, using digital badges to analyse where they went, to whom they spoke and how stressed they were.

Is this creepy or clever?

According to the manufacturer of the badges, US company Hamanyze, the surveillance helped uncover why some bank branches were outperforming others by more than 300 per cent.

Discovering that employees at the “star” branches interacted more frequently – seeing and talking to each other more often – the bank redesigned its offices to encourage people to mix and offered group bonuses to encourage collaboration.

As a result, the lagging branches reportedly increased their sales performance by 11 per cent.

The results in this case seem to indicate this is a clever use of digital technology. The bank had a legitimate reason to track its employees, it was transparent about the process, and the employees could see some benefit from participating.

If it is secret, it’s unethical

Creepy tracking is the unethical use of the technology – where employees don’t know they are being monitored, where there is no benefit to them and the end result is an erosion of trust.

In the UK, for instance, employees at the Daily Telegraph were outraged when they discovered motion detectors had been installed under their desks without their knowledge or consent. They insisted on their removal.

Two years ago, Rio Tinto had to deny it was planning to use drones to conduct surveillance on its workers at a Pilbara mining site after some comments by an executive of Sodexo (which was under contract to provide facilities management to Rio Tinto). Those comments about drone use were later described as “conceptual”.

Employee surveillance during work hours is allowed in Australia if it relates to work and the workers have been informed about it, however legislation varies between the states and territories.

Deciding where ethical and privacy boundaries lie is difficult. It depends on individual sensibilities, but the ground also keeps shifting. As a society, we are accepting increasing amounts of monitoring, from psychometric assessments and drug tests, to the recording of keystrokes, to the monitoring of personal social media accounts.

Co-head of advice and education at The Ethics Centre, John Neil, says legislation is too slow to keep up with rapidly advancing technologies and changing social attitudes.

“It is difficult to set binding rules that stand the test of time,” he says. “Organisations need guiding principles to ensure they are using technologies in an ethical way”.

Guiding principles are required

The Institute of Electrical and Electronics Engineers have developed ethical principles for artificial intelligence and autonomous systems. These state the development of such technologies must include: protecting human rights, prioritising and employing established metrics for measuring wellbeing; ensuring designers and operators of new technologies are accountable; making processes transparent; minimising the risks of misuse.

Principles such as these can help businesses and people distinguish between what is right, and what is merely legal (for now).

Putting aside the fact that employee monitoring is allowed by law, the key to whether workers accept it depends on whether they think it will be good for them as individuals, says US futurist Edie Weiner.

People may not mind their movements being tracked at work if they believe the information is being used to improve the working environment and will benefit them, personally.

“But if it was about figuring out how to replace them with a machine, I think they would really care about it,” says Weiner, President and CEO of The Future Hunters. Weiner was in Sydney recently to speak at the SingularityU Australia Summit, held by the Silicon Valley-based Singularity University

When it comes to privacy considerations, Weiner applies a formula to understand how people accept intrusion. She says privacy equals:

- Your age

- Multiplied by your technophilia (love of technology)

- Divided by your technophobia (fear of technology)

- Multiplied by your control over the information being collected

- Multiplied again by the returns for giving up that privacy.

“Each person figures out the formula and, if the returns for what they are giving up is not worth it, then they will see that as an invasion of their privacy,” she says.

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Explainer

Business + Leadership, Politics + Human Rights

Ethics Explainer: Liberalism

Reports

Business + Leadership

Trust, Legitimacy & the Ethical Foundations of the Market Economy

Opinion + Analysis

Business + Leadership

How avoiding shadow values can help change your organisational culture

Opinion + Analysis

Business + Leadership

Ask the ethicist: Is it ok to tell a lie if the recipient is complicit?

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Moral injury is a new test for employers

Moral injury is a new test for employers

Opinion + AnalysisBusiness + Leadership

BY Matthew Beard The Ethics Centre 1 JAN 2018

When I am unsure if something is ethical, my favourite ‘ready reckoner’ is to apply the reflection test – I ask myself if I could look myself in the mirror after doing it.

Would my self-image be helped or hindered by the action? I could also call it ‘the slumber test’. Will I be able to sleep at night after doing what I’m setting out to do?

I’ve spent years studying the ethical and psychological toll that comes with doing things that stop us from meeting our own eyes in the mirror. There is a price that comes when we violate our most precious moral beliefs.

In military communities, this price is called a ‘moral injury’. Psychiatrist Jonathan Shay, the foundational voice on the subject, describes it poetically as “the soul wound inflicted by doing something that violates one’s own ethics, ideals, or attachments”.

This needs attention

As parochial as talk of souls might be, organisations should start paying attention to this risk for three reasons:

- So they can take steps to prevent their workers from being affected by moral injuries (basically, as an OH&S issue).

- So they know how to spot and manage moral injuries if they do occur.

- To figure out what support and remuneration they should offer if it turns out moral injuries are an ‘occupational hazard’.

The OH&S analogy is apt. Today, we expect organisations to think about their duty of care in a broad sense – taking an active interest in their employees’ wellbeing, seeking to reduce the risk of physical injuries, managing and minimising psychological stressors and mental illness, and providing fair training, support, and compensation when physical or mental stressors are likely to have a negative effect on employee wellbeing.

So, it follows that if some ethical issues can have an effect on wellbeing, they should be treated seriously by organisations claiming to care about their people.

How moral injury takes place

Moral injury is still a contested topic. Some people think it’s just a variation of post-traumatic stress disorder (PTSD), others think it’s no different from moral emotions like guilt, regret or remorse, and others still see it as something distinct.

Among veterans (who tend to dominate discussions of moral injury), the condition is seen as a condition akin to PTSD – a different kind of war trauma with different causes and different treatment pathways.

Whilst PTSD originates in feelings of fear and physical insecurity, moral injuries arise when we witness a betrayal or violation of our most deeply held beliefs about what’s right. It has to happen in a high stakes situation and the wrongdoing has to have been committed by someone in a position of ‘moral authority’ – a position you yourself might hold.

A group of US psychologists who have studied the issue offer a similar definition, describing moral injuries as “maladaptive beliefs about the self and the world” that emerge in response to the betrayal of what’s right. The injury is caused by the betrayal, but it’s in the beliefs and our response to them that it actually resides.

When we suffer a moral injury, our beliefs about ourselves, our world, or both are shattered in the wake of what we’ve witnessed or done.

Our moral beliefs are one of the ways we see the world and one of the ways we conceptualise ourselves. Everything flips when people no longer adhere to a ‘code’, good people are forced to do bad things for good reasons, or our different identities contradict one another.

This contradiction gives rise to ‘fragmentation’. Our moral beliefs, identities and actions no longer harmonise with one another. In the words of Les Miserables’ Inspector Javert, we find ourselves thrown into “a world that cannot hold”. Fragmentation demands reunification, and the way we go about this will determine both the extent of the moral injury and the likelihood of recovery.

How we respond to the conflict

If we can accept the critical event as being a rare product of extreme circumstances and a particular context, it’s possible to move on. We can accept guilt and seek forgiveness, admit our trust in a moral authority was betrayed and sever ties, or concede that the world is not as fair as we had thought.

This approach is relatively risk-free, albeit unpleasant.

However, if we are unable to see the event as context-dependent and, instead, see it as reflecting something universal – or worse, something about us – then a moral injury is likely to occur.

For example, if we have a handshake agreement to honour a business deal which is then betrayed, leading to widespread unemployment, we might decide that people are no longer trustworthy and either withdraw from them altogether or ‘get them before they get us’ next time. Either approach has an impact on a person’s ability to flourish in society.

Another possibility lies in concluding that we must be bad in order for us to have done what we did. Even if we were doing our duty without fault, guilt lingers and an employee could be permanently tainted by what they have done: “How can I say I am a good person when my actions resulted in this?”

Finally, we can recalibrate our moral beliefs. Perhaps, as many veterans argue, we were wrong to think the world was predictable or reliable to begin with. Maybe our moral injury isn’t an injury at all. Perhaps it’s a sign we’ve learned something new.

What employers can do

Moral injuries must be addressed because they affect a person’s future ethical decision making and their capacity for happiness.

This gives organisations another reason to have a robust ethical culture that guards against wrongdoing and refuses to ask people to act against their conscience.

However, this won’t always be possible. Sometimes professional demands require people to ‘get their hands dirty’, witness wrongdoing or even participate in something they feel contradicts their moral beliefs.

A committed parent may be required to decline an insurance claim, leaving the claimants – a family– homeless. How will he go home and sit with his children knowing his actions have put another family in jeopardy? A nurse may be legally prohibited from helping someone to end their life. Can she be a good person while allowing someone to needlessly suffer?

The question of moral injury has typically been posed as an individual problem but, if the OH&S analogy is a valid one, we should think about the responsibilities of organisations in the wake of what we’re learning.

An organisation violates its duty of care if it exposes workers to risk without reason, consent, support or fair compensation. Perhaps we might say the same for moral injuries, with one important caveat: it would be perverse and potentially corruptive to offer financial incentives for people to compromise their values and moral beliefs, offering a salary increase to be exposed to ethical risks, for instance.

A clear ethical purpose with which staff can identify and that is consistent with their moral beliefs is a more appropriate incentive. Not only might this prevent wrongdoing in the first instance, it can help reunify a fragmented identity if a moral injury does occur.

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

WATCH

Health + Wellbeing, Business + Leadership

Moral injury

Reports

Business + Leadership

The Ethical Advantage

Opinion + Analysis

Health + Wellbeing, Business + Leadership

Repairing moral injury: The role of EdEthics in supporting moral integrity in teaching

Opinion + Analysis

Business + Leadership

The value of principle over prescription

BY Matthew Beard

Matt is a moral philosopher with a background in applied and military ethics. In 2016, Matt won the Australasian Association of Philosophy prize for media engagement. Formerly a fellow at The Ethics Centre, Matt is currently host on ABC’s Short & Curly podcast and the Vincent Fairfax Fellowship Program Director.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Sell out, burn out. Decisions that won’t let you sleep at night

Sell out, burn out. Decisions that won’t let you sleep at night

Opinion + AnalysisBusiness + Leadership

BY Fiona Smith The Ethics Centre 1 JAN 2018

Nick Naylor is a man who is comfortable being despised. In the movie Thank You for Smoking, he is the spokesman for the tobacco lobby and happily admits he fronts an organisation responsible for the deaths of 1,200 people every day.

While he excuses his employment as a lobbyist by unconvincingly adopting the “Yuppie Nuremberg defence” of having to pay a mortgage, the audience learns that his real motivation is that he loves to win.

The bigger the odds, the better.

Naylor is not the sort of man who would struggle with ethical distress or moral injury from the work he chooses to do. This work “requires a moral flexibility that is beyond most people”, he says.

He likens his role to that of a lawyer, who has to defend clients whether they are guilty or not.

Partner of law firm Maurice Blackburn, Josh Bornstein, says the convention in law that everyone deserves legal representation can certainly assist lawyers called upon to defend people whose actions they find morally reprehensible – however that argument does not work for everyone.

‘If I don’t, someone else will’

Bornstein says there is no way of knowing how many lawyers refuse to work on cases because of moral conflict, but it happens from time to time. “Not every week or every month”, he adds.

“Do [lawyers] have moral crises? Some people have a strong sense of morality and others try and sweep that to one side and consider that, as professional lawyers, they shouldn’t dwell on moral concerns”, says Bornstein, who specialises in workplace law.

Bornstein is well known for his advocacy for victims of bullying and harassment, however, he has also acted for people accused of those things.

“I’ve found myself, from time to time, acting in matters that have been very morally confronting”, he says.

As a young lawyer, when he was expressing his disapproval of the actions of a client, his mentor told him to stop moralising and indulging himself.

“He said that when people like that get into that trouble, that is the time they need your assistance more than any other. Your job is to help them, even when they have done the wrong thing”, says Bornstein.

Bornstein says ethical distress can occur in all sorts of professions. “I would think the same would occur for a psychologist, social worker, doctors, and maybe even priests.

“Consider the position if you were lawyers for the Catholic Church over the last three decades, dealing with horrific, ongoing cases of child sexual abuse.”

Distress or injury? Making a distinction

The CEO of Relationships Australia NSW, Elisabeth Shaw, says when seeking to understand the psychological damage wrought by such conflicts, a distinction should be made between ethical (or moral) distress and moral injury.

Ethical or moral distress occurs when someone knows the right thing to do, but institutional constraints make it nearly impossible to pursue the right course of action.

This definition is often used in nursing, where staff are conflicted between doing what they feel is right for the patient and what hospital protocol and the law allows them to do. They may, for instance, be required to resuscitate a terminally ill patient who had expressed a desire to end the pain and die in peace.

Moral injury is a more severe form of distress and tends to be used in the context of war, describing “the lasting psychological, biological, spiritual, behavioural, and social impact of perpetrating, failing to prevent, or bearing witness to acts that transgress deeply held moral beliefs and expectations”.

The St John of God Chair of Trauma and Mental Health at the University of New South Wales, Zachary Steel, says most moral injuries stem from “catastrophic traumatic encounters”, such as military and first responder types of duties and responsibilities.

He says he sees moral injury as a variant of post-traumatic stress disorder and distinguishable from the kind of moral harm wrought by bullying and highly dysfunctional workplaces.

Tainted by your compliance

This distinction does not diminish the distress experienced by those who are torn between what they are expected to do, and what they know they should do.

Shaw, who has volunteered at The Ethics Centre’s Ethi-call hotline for eight years as team supervisor, says the service handles around 1,500 calls per year and a typical request for advice may come from an accountant who is pressured to sign off on dodgy records.

“After [complying], you may feel a lesser version of yourself. You may feel you didn’t have a choice, but also feel quite tainted by those actions”, she says.

“Even if you went to great lengths to do all the things that could be seen to be correct, you can still feel very injured at the end of it.”

For some people, it is the nature of the organisation they work for, or its culture, that creates a problem.

“Some people feel like they are part of an organisation that is, perhaps, habitually part of shabby behaviour”, says Shaw.

Someone working for a tobacco company (like the fictional Nick Naylor) may start by shrugging off concerns, reasoning that they need the job and if they don’t do it, someone else will. However, over time, embarrassment grows and they become more aware of the disapproval of others and they start to feel morally compromised, says Shaw.

“And then there is a point where it feels like [your job] has injured your sense of self … or even your professional identity and, in fact, might make you feel less than yourself.”

There are also professions where people sign up for noble reasons, in a not-for-profit, for instance, but then find unjustifiable things are happening.

“You start to feel like there is a huge dissonance – that can no longer be resolved – between what you say you are doing and what you are actually caught up in.”

Can’t tell right from wrong

Burnout and mental health conditions such as anxiety and depression can result from this stress and some people become so ethically compromised they lose their moral compass and no longer can tell right from wrong, she says.

Moral distress is one of a range of factors contributing to the poor record of the law profession when it comes to the incidence of mental health issues, says Bornstein.

A third of solicitors and a fifth of barristers are understood to suffer disability and distress due to depression.

Some of the more “sophisticated” firms encourage their people to seek assistance and offer employee assistance programs, such as hotlines.

Maurice Blackburn has a “vicarious trauma program” for lawyers who may, for instance, work with people dying from asbestosis or medical mishaps or accidents.

“Even in my area of employment [workplace law], vicarious trauma is a real risk and problem”, he says.

“So, we have tried to change our culture to be very open about it, speak about it, to regularly review it, to work with psychologists, to have a program to deal with it, to know what to do if a client threatens suicide or self-harm. But it is an ongoing challenge.”

Bornstein has, himself, sought guidance from the Law Institute on ethical dilemmas.

“The other underestimated, fantastic outlet is to confer with colleagues you respect who are, hopefully, one step or more removed from the situation and can give wise counsel. Another is to seek similar support from barristers, I’ve done that too, and then there is friends and family.”

Bornstein says even though he is not aware of any law firm offering a “moral repugnance policy” that would allow people to avoid working on cases that could cause ethical distress, he is aware there would be little benefit in forcing a lawyer to take one.

“It may be resolved by [getting] someone else working on the case.”

The value of a strong ethical framework

Social work is another area that is fraught with ethical dilemmas and, like lawyers, social workers often see people at their worst.

However, the profession has a developed an ethical framework and support system that ensures workers are not left alone to tackle difficult dilemmas, says Professor Donna McAuliffe, who has spent the past 20 years teaching and researching in the area of social work and professional ethics.

“The decisions that social workers have to make can be very complex and distressing if they are not made well”, says McAuliffe, who is Deputy Head of School at the School of Human Services and Social Work at Griffith University.

Social workers have a responsibility, under their code of ethics, to engage professional supervision provided by their employer.

Because social work in Australia is a self-regulated profession, it is important to have a very robust and detailed code of ethics to give guidance around practise, she says.

“We educate social workers to not go alone with things, that consultation and support of colleagues are going to be the best buffers against burn out and distress and falling apart in the workplace – and there is evidence to show good collegial, supportive relationships at work is the thing that buffers against burnout in the best way.”

McAuliffe says employers in business may think about building into their ethical decision making frameworks some consideration of the emotions, worldview, and cultures of the people affected by difficult workplace choices.

“The decision may still be the same … but the [employee] will feel a hell of a lot better about it if they know they have thought about how the person at the end of that decision can be supported.”

Shaw cautions that people should try and seek other perspectives before making decisions about situations that make them feel morally uncomfortable.

“Part of the process of ethical reflection is to work out, ‘Do I have a point?’

“Because we are all developed in different ways ethically, just because you have a reaction and you are worried about something and you feel ethically compromised doesn’t make you correct.

“What it means is that your own moral code feels compromised. The first thing to do is spend some time working out, is my point valid? Do I have all the facts?

“What do I do about the fact that my colleagues and bosses don’t feel bothered? Should I look at their point of view?

“Sometimes, when you feel like that, it really is a trigger for ethical reflection. Then, on the basis of your ethical reflection, you might say, ‘You know what? Now that I have looked at it from many angles, I think, perhaps I was over-jumpy there and I think if I take these three steps, I could probably iron this out, or if I spoke up, change might happen.’

“And then the whole thing can move on.

“Having a reaction to what feels like an ethical trigger is really just the beginning of a process of self-understanding and the understanding in context.”

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Science + Technology

Is technology destroying your workplace culture?

Opinion + Analysis

Business + Leadership, Politics + Human Rights

Why fairness is integral to tax policy

Opinion + Analysis

Business + Leadership

6 Things you might like to know about the rich

Opinion + Analysis

Business + Leadership

Workplace ethics frameworks

BY Fiona Smith

Fiona Smith is a freelance journalist who writes about people, workplaces and social equity. Follow her on Twitter @fionaatwork

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

The pivot: ‘I think I’ve been offered a bribe’

The pivot: ‘I think I’ve been offered a bribe’

Opinion + AnalysisBusiness + Leadership

BY Steven York The Ethics Centre 1 JAN 2018

The man waiting for me in the meeting room was an unexpected visitor. He introduced himself as the head of a government department and welcomed me to the Czech Republic. He had brought a “friend”.

“You are going to have meet your budget, but I can give you all the government work you need”, he said with a meaningful look. “I just want you to employ this girl.”

He pointed to the young woman who sat opposite. She was beautiful, breathtakingly so, and I suspected she was to be a “spy” for the government. Working on behalf of British and US lenders, I was leading a team investigating cases of fraud that often wound their way back to organised crime and government figures.

I was just a few months into my posting to Eastern Europe and I knew to be wary. This is a country where surveys show two thirds of Czech citizens (66%) believe that most, or almost all, public officials are corrupt.

I left the room, grabbed the arm of my direct report and said, “I think I have just been offered a bribe”.

My first strategy was to make the problem go away by making it clear that everything was to be “above board”.

I walked back into the meeting room. “Leave it with me”, I said. “Look, it sounds interesting, send me her CV and we will see where she may fit in the organisation.”

I had made no commitment, but had asked him to “make it official”. But that was not the end of it. No CV arrived, but three weeks later he was back, unsmiling this time.

“If you don’t employ her, you won’t get any government work at all”, he threatened. I thanked him, said I understood what he was talking about and asked him once more to send the CV. He left without shaking my hand.

A senior leader within the organisation I worked for pulled me up the following day to berate me for being so stupid. Bribes and corruption are a ubiquitous part of the business environment in some countries.

While the organisation might have seen a brown paper bag full of cash as corruption, “scratching each other’s back” in this way was regarded as mere facilitation.

It came to me right then, that this was a real turning point.

With 20 years in the NSW Police behind me, I thought I was a bit of a tough guy, but I knew my life was about to change if I did not change my mind about hiring the “spy”. This could be a dangerous situation because of the kind of people involved in corruption.

It became clear that I had become a problem to the people running the Prague office. At every executive meeting, the others would roll their eyes when I spoke. Their attitude was that we had to get the business, no matter what. Eventually I had to leave before my contract was up.

Looking back through the intervening years, are there things I would have done differently? Perhaps I should have tried being upfront with the CEO – however, he was new to the job and was part of the “giggle”.

I thought at the time that it was better to leave the matter “intangible”, to not start a fight when I was the only Australian in the office.

I had let them know where I stood – a strategy that worked well in the Police Force where, if you were known as a straight shooter, people wouldn’t approach you with corrupt offers.

I could have done more research to find out what was the normal way of conducting business there. I knew there was a lot of corruption in the country, but I had thought the organisation I was working for was above that. It wasn’t. It was part of it.

I could have made my ethical standards clear to the CEO and management team before I started. If I had known their attitude, I would not have taken the job. If they had known mine, they wouldn’t have hired me.

My advice to others in this situation is to bring the matter out into the open, but think about your personal safety. Make sure you have a good exit plan.

An interesting thing about the culture of corruption is it can be invisible. If you didn’t look out the window into the Prague winter, you would think you were in Australia. The building was the same, the people were the same. So, you could be seduced into thinking you could operate the same way there as you do in Australia, but the culture is so very different.

.

This article was originally written for The Ethics Alliance. Find out more about this corporate membership program. Already a member? Log in to the membership portal for more content and tools here.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.