Why ethical leadership needs to be practiced before a crisis

Why ethical leadership needs to be practiced before a crisis

Opinion + AnalysisBusiness + LeadershipHealth + Wellbeing

BY Dennis Gentilin 9 APR 2020

Crises, especially as momentous as this one, have a habit of exposing leaders. At worst, they expose incompetence and self-interest. At best, they reveal courage, resilience and deep concern for others. It is the latter that is the hallmark of ethical leadership.

Make no mistake, these are challenging times. There are potentially some dark days ahead. Humanity has not faced a perilous situation of this magnitude in my lifetime.

Unfortunately, ethical leadership is not something that can be ‘switched’ on at will. In trying times, one cannot simply dust off the ethical leadership manual and, like a chameleon, transform one’s approach. The reason for this is that ethical leadership is honed through many years of practice.

Ethics is a long game

This is not a new idea. Aristotle described ethical virtue as a “hexis” – a state or disposition – that is shaped by our habits. We come to be ethical by acting ethically, consistently being guided by an ethical framework when making choices, regardless of how difficult this might be given the prevailing circumstances. This is what it means to be a person with integrity.

For this reason the COVID-19 pandemic will (and in some cases already has) reveal what leaders believe to be good (their values) and right (their principles). More importantly, it will reveal how committed they are to their ethical core. Those who have failed to make ethical practice a daily habit will find it difficult. They may already have stumbled or are perhaps struggling to win the trust of sceptical followers. For those who have made integrity central to their leadership, the turbulent waters will be somewhat easier to navigate. Making the ethical choice will come more instinctively.

There is also the possibility that ethical leadership will emerge in the current crisis from the most unlikely of places. People whom we may have thought were not cut out to deal with a crisis or a thrust into a position of leadership will rise to the occasion. Perversely, moments like these, instead of paralysing leaders, can provide greater clarity on what is the ‘right’ thing to do. The path one must take, although rocky, lights up and is clearly signed. A leader comes into their own.

Ethical leadership, not perfection

All this being said, one thing that we should not (and cannot) expect is ethical perfection. In situations like these where there are excruciating trade-offs associated with many decisions, ethical perfection cannot be defined. The available choices are evenly balanced, providing a myriad of possible outcomes that all have considerable merit. It would therefore be preposterous to think that any leader in these circumstances, no matter how ethical, will get everything ‘right’. We should respect those who are being called upon to make extraordinarily difficult decisions, with imperfect information, in a highly dynamic environment.

However, there are some minimal expectations we should expect from our leaders. We should expect a degree of candour and honesty, accepting that in some cases full transparency will do more harm than good. We should expect that the safety of people – particularly the most vulnerable – is prioritised, accepting that there will be unfortunate loss of life. Above all, we should expect leaders to act with sincerity, rely on the best available evidence and display ethical competence. ‘Winging it’, ‘intuition’ and ‘common sense’ are not enough.

We all have a role to play

We should also understand that ethical leadership is not reserved for those who sit highest in the hierarchy, especially in unprecedented moments like these. This is something that can’t be underestimated. Ethical leadership will need to emerge at every level of society if we are to find a way through what will be some very difficult weeks and months ahead. Do not discount our essential role as ethical citizens.

Jon Haidt, a professor of ethical leadership at the Stern School of Business at NYU, talks about how morality “blinds and binds”. It can evoke the passions and bind people around a common cause. However, in doing so, it can breed dogmatism and drive us into our ideological camps, blinding us to our common humanity.

For the first time in a while, the coronavirus has created a present and common cause that all of humanity can bind to. It will test our leaders and in doing so reveal those who make ethics more than a word in their by-line. It will produce benevolent and heroic acts among citizens that extreme circumstances like these so often educe. And hopefully, by producing a cause we can all be bound by, it will dampen some of the tribalism and self-interest that has been an unfortunate feature of some sectors of our society in recent times.

You can contact The Ethics Centre about any of the issues discussed in this article. We offer free counselling for individuals via Ethi-call; professional fee-for-service consulting, leadership and development services; and as a non-profit charity we rely heavily on donations to continue our work, which can be made via our website. Thank you.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Science + Technology, Business + Leadership

Ask an ethicist: Should I use AI for work?

Opinion + Analysis

Business + Leadership, Health + Wellbeing

Is your workplace turning into a cult?

Opinion + Analysis

Business + Leadership

6 Things you might like to know about the rich

Opinion + Analysis

Health + Wellbeing, Relationships

Anthem outrage reveals Australia’s spiritual shortcomings

BY Dennis Gentilin

Dennis Gentilin is an Adjunct Fellow at Macquarie University and currently works in Deloitte’s Risk Advisory practice.

Navigating a workforce through stressful times

Navigating a workforce through stressful times

Opinion + AnalysisBusiness + LeadershipHealth + Wellbeing

BY Michelle Bloom The Ethics Centre 6 APR 2020

COVID-19 has created a cascade of unprecedented changes to how we work, live and interact.

With many organisations moving online, managing restructures, significant job loss and transformation of existing roles and responsibilities, leaders need to be consciously aware of the impact of stress on individual and team performance.

Certain aspects of organisational behaviour can trigger threat reactions in people that impede their effectiveness and limit their ability to contribute to the success of the team. Research in neuroscience can inform our response to such situations, as the neural functioning of individuals within the workplace underlies the social nature of high performance.

What happens to us in stressful environments

The brain is a social organ. Studies by UCLA have found that when we feel excluded from play or rewards, our brains trigger a response from the same neural regions associated with the distress that comes with physical pain. This neurophysiological link has been explained as evolutionary, a developmental hangover from the dependency of infancy. As UCLA neuroscientist Matthew Liebermann puts it, “To a mammal, being socially connected to caregivers is necessary for survival”.

This neurological response has a number of implications for business and leaders navigating this current crisis – especially in regards to remote working and communicating organisational changes driven by COVID-19.

A person who feels their position and work to be valued, by their leaders, solely as an economic and rational transaction (labour for money) will likely feel betrayed, unrecognised and disengaged.

Research shows that each time a person feels like this, it is physiologically and psychologically analogous to a ‘blow to the head’ and is processed in the brain in the same way as physical pain. Naturally, our conscious selves rationalise the discomfort, but if this situation is chronic and ongoing, it is more likely that employees will begin to desensitise in self-protection. They will effectively push the discomfort away, so as to not feel it consciously. This shutting down of large parts of our response pathways disables us, making high-performance impossible.

Many studies, including Paul MacLean’s infamous “Triune Brain” theory, look at how fear responses negatively impact the quality of mental functioning. In more mild circumstances, the emotional centres associated with the limbic brain will interfere with the circuitry of the logical neo-cortex. In extreme circumstances, our ‘fight, flight, freeze’ response gets triggered, creating a chemical reaction that entirely hijacks the brain’s emotional centre, the amygdala, making logical thinking impossible.

However you conceptualise it, high emotion is disastrous for the adaptive thinking required for complex problems – so critical for ethical decision making.

Physiologically, the threat response ties up glucose and oxygen, as lower areas of the brain, more intimately concerned with survival, take precedence over higher centres. In threat situations, these resources are withheld from working memory, impairing the processing of new information or ideas, and slowing analytic thinking, creativity and problem solving.

Addressing the needs of the individual and the organisation

We’ve all heard that adults are poor learners, fundamentally intractable, or that their natural response to change is resistance. While elements of these statements are true, what is also true is that the adult brain continues to be highly plastic; albeit not as much as children or infants. That means that not only can behaviours change, but that the neural networks that underlie all thought and behaviour are in fact changing every day.

To increase the chances of your business being high-performing, David Rock’s SCARF Model, as outlined in his paper “SCARF: A Brain-Based Model for Collaborating with and Influencing Others,” suggests that leaders should look at how the organisation deals with the following aspects of individual functioning in the collective social system.

1. Certainty

Our brains are wired to crave certainty. This desire is underpinned by neural circuits that register unexpected events as gaps or errors. Because an assumed pattern is no longer functioning as it should, it is registered as a threat.

Think about how you respond when the car in front slams on the brakes. Normally, we can do multiple things at the same time when we drive – hold a conversation, listen to music, monitor what’s going on around us, think about the shopping list – but faced with a potential accident, your working memory is diminished. All other activities and thoughts must cease as you shift full attention to the potential threat ahead.

Some uncertainty can be intriguing and enjoyable; too much leads to panic and bad decisions. For many people right now, the levels of uncertainty – combined with imminent health and employment risks – will be triggering this aspect of the ‘fight or flight’ response. This impedes their capacity to access creative thinking and good decision making.

Of course, certainty is an illusion. However, people need a semblance of certainty in order to perform. Leaders need to build confidence in their people so they, in turn, can trust in individual and collective capability to work through whatever comes. Keeping a clear and regular stream of communication around how decisions are being made increases trust and promotes engagement. Chunking larger problems into shorter time frames also helps people feel more certain.

2. Status

As humans, our relative status within social systems matters. This is the basis for all competition, social hierarchy, and, conversely, much social unrest. Many organisations have processes and practices that threaten people’s status. Hierarchy reinforces a notion of ‘greater than’ and ‘less than’, while performance appraisals and coaching generally place one person in the position of being more knowledgeable, capable and powerful than the other. Unless these interactions are carefully considered and thoughtfully executed, they will feel threatening to an individual’s status.

Actions that enhance status include private, as well as public, recognition. In addition, the quality of interactions from leaders with their people can raise the self-status of those who sit lower in the hierarchy. Therefore, one of the most important (albeit intangible) skills of a leadership team is their capacity to interact with others in a respectful and status-enhancing way.

With staff working digitally, and from home, leaders need to innovate and find new ways to show this recognition. This will make people feel seen and valued for the work they do.

3. Autonomy

When people feel they can execute their own decisions, without interference, their felt stress is lower. In a 1977 study, residents of aged care facilities who had more agency and decision making rights, lived longer and healthier lives. While what they were deciding about was insignificant; their autonomy was critical. In another study, franchise owners principally left corporations citing work-life balance. Once in their own business, they generally worked longer hours, for less money, and nevertheless reported better work-life balance, because they were making their own decisions.

Delegation systems, hierarchy, confusing reporting lines, moribund policy and procedure, and parochial mindsets can all contribute to less agency for individuals in businesses. Often people are not aware that they are not delegating, that they are effectively withholding decision making from others.

Lack of autonomy is also closely linked with the phenomena of people not working ‘at the right level’. When leaders find themselves working at a level of complexity lower than where they should be working, the flow on to the rest of the organisation is usually inevitable.

4. Relationships

Perceived difference is another human threat-trigger. Collaboration, trust and empathy are predicated on perceiving that the ‘other’ is from the same social group as we are. The decision of friend or foe is usually made in milliseconds.

The organisational implications for bringing groups together are profound. Forming new relationships at this time, such as buddy systems or mentor programs, need to be carefully thought through so as to minimise the potential to ‘spook the horses’. The creation of productive strategic relationships requires repetition via multiple, sequential opportunities and reinforcement through the removal of organisational impediments.

5. Fairness

Fairness is a cognitive construct that motivates people so strongly they will persist in situations that are manifestly unfavourable because they value a perceived fairness on the part of an organisation or a cause. Consider how people historically have volunteered to fight in wars that are not their own, such as the Spanish Civil War, and are prepared to die based on apparent fairness.

People not only want to avoid being unfairly discriminated against, they will also often feel uncomfortable if they find themselves being unfairly favoured by a person or a situation.

Organisationally, the implications are similar and connected to that of certainty. People will be much more accepting of decisions and processes, as fair, if they are transparent.

Fairness is also related to status in that people will feel fairly dealt with if they perceive they are respected as a person and employee. These principles are often coded as ‘natural justice’. In some ways, fairness is an amalgam of the previous four areas of concern.

What leaders need to think about

The upshot for leaders is this – when you trigger a threat response in others, you make them less effective. When you make people feel good about themselves, clearly communicate your expectations and give agency through appropriate delegations, people feel a reward response which is intrinsically engaging – something your people want more of.

In situations where threat is felt to be ongoing, people typically experience burnout. This emotional exhaustion is a result of chronic over-stimulation of the fear centres of the brain. Physiologically, high levels of adrenalin and cortisol can only be supported for so long before they start to damage the nervous system.

Where these sorts of threatening social conditions are widespread, ongoing or both, each individual’s sub-optimal reaction is reinforced by the reactions of the people around them, magnifying the pattern. This looks like ‘learned helplessness’, passivity or protective withdrawal. Sometimes it drives an aggressive pattern where individuals seek authoritarian control over whatever small part of their world they feel they can have an effect on.

Practical steps that can be taken during COVID-19

If you’re an organisation transitioning working roles or letting go of staff due to the impacts of COVID closures, ensure you are both transparent and compassionate in your communications.

Be clear and straight forward about how government policy impacts your workers, keep them informed of the decisions being made and communicate the rationale behind them, particularly when they impact others.

When communicating changes, respect for the people affected is crucial. While your decisions have economic drivers, there are very real human costs associated with the outcomes.

Relationships and connection are of heightened importance now. Take care in implementing processes to foster positive relationships between people – whether by virtual catch ups, a mentor support system, or regular virtual check ins by managers with their staff to see how they are coping and adjusting.

Tension will also be high, and any perceived difference may trigger as a threat. Leaders will need to be conscious of how relationships are managed between staff who may be actively competing for scarce resources or roles, if facing redundancies.

None of these strategies ameliorates the situation

It is the responsibility of the leaders of the transformation to monitor if what is going on in their organisation is supporting or undermining people’s performance. If performance is being undermined, it is their responsibility to raise those instances to awareness of their peers in the leadership team, to mobilise and support staff to break the prevailing patterns and to experiment with alternative approaches.

Navigating the changes ahead won’t be easy, and for many this may be the hardest professional challenge they’ve had to face given the stakes have never been so high. But careful attention to how decisions are made and communicated is critical to staff safety and wellbeing in the current climate. And that’s never been more important.

You can contact The Ethics Centre about any of the issues discussed in this article. We offer free counselling for individuals via Ethi-call; professional fee-for-service consulting, leadership and development services; and as a non-profit charity we rely heavily on donations to continue our work, which can be made via our website. Thank you.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Measuring culture and radical transparency

Opinion + Analysis

Business + Leadership

Pay up: income inequity breeds resentment

Reports

Business + Leadership

Trust, Legitimacy & the Ethical Foundations of the Market Economy

Opinion + Analysis

Health + Wellbeing, Politics + Human Rights

Don’t throw the birth plan out with the birth water!

BY Michelle Bloom

Michelle Bloom is the Director of Consulting and Leadership at The Ethics Centre. Drawing on 30 years as a consultant, clinician, and organisational development specialist, she has worked with Australia’s largest organisations in developing and delivering solutions to assess and build value-driven leaders and cultures.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Could a virus cure our politics?

Could a virus cure our politics?

Opinion + AnalysisBusiness + LeadershipPolitics + Human Rights

BY Simon Longstaff The Ethics Centre 27 MAR 2020

The COVID-19 pandemic of 2020 will no doubt be remembered for many things.

I wonder if one of the more surprising outcomes will be that our political leaders collectively managed to win back the trust and legitimacy they squandered over the past couple of decades. I hope so – because as we are now seeing in this time of crisis, it really matters.

The past few days have seen Prime Minister Scott Morrison describe panic-shoppers as engaging in behaviour that is “ridiculous” and “un-Australian”. He has had a crack at people who flocked to Bondi Beach in the recent warm weather for not taking seriously the requirements for physical distancing. He is right on both counts. However, his message is blunted by the lack of authority attached to his office. This is part of a larger problem.

The government’s meta-narrative is now one in which responsibility for the nation’s fate is tied to the behaviour of its citizens. The message from our political leaders is clear: ‘You – all of you (the people) – must take responsibility for your choices’.

Again, they are right. It’s just a terrible pity that the potency of the message is undermined by the hypocrisy of the messengers – a group that has refused to take responsibility for pretty much anything – in recent years.

Consider the most recent case of the infamous Sports Rort – in which Government Ministers (including the Prime Minister) offered the ‘Bridget McKenzie’ defence that ‘no laws were broken’. They wriggled and squirmed even further – in an attempt to deflect any and all criticism. Of course, ordinary Australians saw through the evasions and put it all down to political ‘business as usual’.

I recognise that it is unfair to focus on a single incident as indicative of all that has happened to erode trust and legitimacy. McKenzie and Co’s behaviour is just the most recent example of a longer, larger trend. A more equitable reckoning would say to the whole of the political class that we are sick of your blame-shifting, your evasiveness, your self-serving hair-splitting, your back-stabbing, your blatant lies (large and small), your reckless (no, gutless) refusal to accept responsibility for your errors and wrong-doing … your loyalty to the machine rather than to the people whom you are supposed to serve.

The split between ethics and politics was not always so evident. For Ancient Greeks, like Aristotle, each was a different side of a single coin. Ethics dealt with questions about the good life for an individual. Politics considered the good for the life of the community (the polis). The connections were not accidental – they were intrinsic to the understanding of the relationship between people and the communities of which they formed a part. As Umberto Eco once observed, the ancient world was a place of depth populated by heroes. In contrast, we moderns are fascinated by glittering surfaces and find satisfaction in celebrities.

The shallowness of much of modern life has fed into our politics – an arena within which marketing spin too often takes precedence over substance. Some seek to excuse this tendency by saying that our politicians merely reflect the society they represent. It is said that we should demand nothing more of political leaders than what we expect of ourselves. Really? Is that really good enough?

So, how should we respond to this?

Let’s write to our politicians, phone their offices … bombard them with messages of encouragement. Let’s ask them to rise to the occasion – to prove to us (and perhaps to themselves) what they could be.

Let’s appeal to the neglected idealist living buried beneath the callouses. Let’s tell them that they are needed; that they have a noble calling. Let’s enrol them in our dream of a better democracy – one that truly serves the interests of its citizens. Let them be our champions – let them drive out of their ranks anyone who refuses to be and do better.

Let’s imagine what it would be like if, at the end of this year, we were proud of our politicians and the quality of government that they had offered us at a time of crisis.

You can contact The Ethics Centre about any of the issues discussed in this article. We offer free counselling for individuals via Ethi-call; professional fee-for-service consulting, leadership and development services; and as a non-profit charity we rely heavily on donations to continue our work, which can be made via our website. Thank you.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Politics + Human Rights, Relationships

Adoption without parental consent: kidnapping or putting children first?

Opinion + Analysis

Politics + Human Rights, Relationships

What do we want from consent education?

Opinion + Analysis

Business + Leadership

Dame Julia Cleverdon on social responsibility

Opinion + Analysis

Politics + Human Rights, Science + Technology

Who’s to blame for Facebook’s news ban?

BY Simon Longstaff

Simon Longstaff began his working life on Groote Eylandt in the Northern Territory of Australia. He is proud of his kinship ties to the Anindilyakwa people. After a period studying law in Sydney and teaching in Tasmania, he pursued postgraduate studies as a Member of Magdalene College, Cambridge. In 1991, Simon commenced his work as the first Executive Director of The Ethics Centre. In 2013, he was made an officer of the Order of Australia (AO) for “distinguished service to the community through the promotion of ethical standards in governance and business, to improving corporate responsibility, and to philosophy.” Simon is an Adjunct Professor of the Australian Graduate School of Management at UNSW, a Fellow of CPA Australia, the Royal Society of NSW and the Australian Risk Policy Institute.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Facing tough decisions around redundancies? Here are some things to consider

Facing tough decisions around redundancies? Here are some things to consider

Opinion + AnalysisBusiness + LeadershipRelationships

BY The Ethics Centre 19 MAR 2020

One of the most difficult decisions an employer will ever have to make is whether or not to dismiss employees during an economic downturn.

Invariably, those at risk of losing their jobs are competent, hard-working and loyal. They do not deserve to be unemployed – they are simply the likely victims of circumstances.

As one employer said to me recently, “I hate the idea of having to be ruthless – but I need to sack forty to save the jobs of four hundred”. So, what are the key ethical considerations an employer might take into account?

-

Save what can be saved

There is no honour in destroying all for the sake of a few. Even the few will eventually perish in such a scenario.

-

Give reasons

Be open and truthful. Throw open the books so that people can see the proof of necessity.

-

Retain the essential

Some people are of vital importance to the life of an organisation. However, when all other things are equal, protect the most vulnerable.

-

Cut the optional

The luxuries, the ‘nice-to-haves’ should not be funded. Use income for the essential purpose of preserving jobs.

-

Treat everyone with compassion

Both those who leave and those who remain will be wounded by the decisions you make – no matter how necessary.

-

Share the pain

consider offering everybody the opportunity to work less hours, for less money, in order to save a few jobs that might otherwise be lost.

-

Seek volunteers

If sacrifices must be made, invite your colleagues to be part of the decision. Some might prefer to step down – their reasons will vary. Honour their choice.

-

Honour your promises

If you have made a specific commitment to a member of staff, then you are bound by it – even in a crisis – unless it is impossible to discharge your obligation.

-

Minimise the damage

Those who lose their jobs should not be abandoned. How can they be supported by means other than a salary?

-

Look to the future

Make sure that your organisation has a purpose that can inspire those who remain – and justify the losses suffered during the worst of times.

You can contact The Ethics Centre about any of the issues discussed in this article. We offer free counselling for individuals via Ethi-call; professional fee-for-service consulting, leadership and development services; and as a non-profit charity we rely heavily on donations to continue our work, which can be made via our website. Thank you.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Relationships

There are ethical ways to live with the thrill of gambling

Opinion + Analysis

Health + Wellbeing, Relationships

Banning euthanasia is an attack on human dignity

Explainer

Relationships

Ethics Explainer: Begging the question

Opinion + Analysis

Relationships

If women won the battle of the sexes, who wins the war?

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

‘Woke' companies: Do they really mean what they say?

‘Woke’ companies: Do they really mean what they say?

Opinion + AnalysisBusiness + Leadership

BY Fiona Smith The Ethics Alliance The Ethics Centre 2 MAR 2020

Virtue-signalling has a bad name. It is often derided as the boasting people do to feel superior – even when they have no intention of living up to the ideal.

It is like when they posted Facebook videos of pouring icy water over their own heads, hashtagged #IceBucketChallenge, but raised no money for research into Motor Neurone Disease.

Or when $US5.5 billion fast food company KFC appeared to use the challenge as a branding exercise, offering to donate up to $10,000 if its own buckets were used.

But here’s the thing: despite free riders and over-eager marketers, the 2014 viral campaign raised more than $A168 million in eight weeks and was able to fully fund a number of research projects.

If some of those getting in on the act gave nothing for the cause, does it matter? It is possible that, by flooding social media with the images, they helped build momentum for an extraordinarily successful campaign.

So, can virtue signalling also have a positive spin?

Conservative British journalist and former banker, James Bartholemew, claims to have invented the term “virtue signalling” in a column for The Spectator in 2015. He wrote: “It’s noticeable how often virtue signalling consists of saying you hate things.”

He says virtue signalling is often a person or brand attempting to aggrandise or promote themselves.

If you were frank, Bartholemew explains, what you would actually say is: “I care about the environment more than most people do” or “I care about the poor more than others”.

“But your vanity and self-aggrandisement would be obvious…”

Bartholemew says the term “virtue signalling” is pejorative in nature: “It is usually used as a judgement on what somebody else is saying. It is a judgement just like saying that somebody is boring or self-righteous. So it is not going to be used to praise somebody, but for taking a particular position.”

Virtue signalling: An attempt to show other people that you are a good person, for example by expressing opinions that will be acceptable to them, especially on social media.

Cambridge Dictionary definition.

It is social bonding

Philosopher and science writer, Dr Tim Dean, says virtue signalling has a social purpose – even when it is disingenuous. It expresses solidarity with a peer group, builds social capital and reinforces the individual’s own social identity.

“It sometimes becomes more important to believe and to express things because they are the beliefs that are held by my peer group, than it is to say things because we think they are true or false,” he says.

A secondary purpose according to Dr Dean is to distinguish that social group from all others, sometimes by saying something other groups will find disagreeable.

“I think a distant tertiary function is to express a genuinely held and rationally considered and justifiable belief.

“We are social first and rational second.”

Organisations use virtue signalling to broadcast what they stand for, differentiating themselves from the rest of the market by promoting themselves as good corporate citizens. Some of those organisations will be primarily driven by the marketing opportunity, others will be on a genuine mission to create a better planet.

A classic act of virtue signalling was the full-page advertisement in the New York Times, taken out last year by more than 30 B Corporations to pressure “big business” into putting the planet before profits. B Corps are certified businesses that balance profit and purpose, such as Ben and Jerry’s, Body Shop, Patagonia and the Guardian Media Group.

“We operate with a better model of corporate governance – which gives us, and could give you, a way to combat short-termism and the freedom to make decisions to balance profit and purpose,” the B Corps declared in their advertisement.

Their stated aim was to chivvy along the leaders in the Business Roundtable: 181 CEOs who had pledged to pledged to do away with the principle of shareholder primacy and lead their companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders.

Whose business is it?

There are some questions leaders should consider before they sign their organisations up to a campaign. In whose interests is a company acting if it lobbies for a social or political cause? How does it decide which issues are appropriate for its support?

The questions are of particular concern to conservatives, who have watched the business community speak up on issues such as gender targets, climate change and an Australian republic.

When the CEO of Qantas, Alan Joyce, pledged his company’s support in favour of the right of gay couples to marry, in 2017, it raised the ire of the conservative think-tank, The Centre For Independent Studies (CIS).

Last year, the centre published Corporate Virtue Signalling: How to Stop Big Business from Meddling in Politics – a book by its then-senior research fellow, Dr Jeremy Sammut.

At the launch of his book last year, Sammut noted recent developments that included Rio Tinto and BHP becoming the first companies to support Indigenous recognition in the Australian Constitution, a group of leading company directors forming a pressure group to push the Republican cause in Australia, while industry super funds were using their financial muscle to force companies to endorse “so-called socially responsible climate change” and industrial relations policies that aligned with union and Labor Party interests.

“If the proponents of CSR [corporate social responsibility] within Australian business, get their way, the kind of political involvement that we saw from companies during the same-sex marriage debate will be just a start,” Sammut said.

“It’s going to prove to be just the tip of the political meddling by companies in social issues that really have very little to do with shareholders’ interests, and the true business of business.”

Sammut pointed the finger at CSR professionals in human resources divisions and consultancy firms: “… they basically have an activist mindset and use the idea of CSR as a rubric, or a license, to play politics with shareholders money.”

Their ultimate ambition is to “subvert the traditional role of companies and make them into entities that campaign for what they call systemic change behind progressive social, economic, and environmental causes – all under the banner of CSR.”

Decide if it is branding or belief

It is not only the conservatives who view corporate virtue signalling with deep suspicion, those who may be considered “woke” (socially aware) can also view the practise with cynicism – especially when they have seen so many organisations pretend to be better than they are.

Dr Tim Dean notes there is a difference between corporate virtue signalling and marketing. While the former reinforces social bonds within a particular group, marketing appeals to people’s values in an attempt to elevate the company’s status, improve the brand and increase sales.

“I have some wariness around corporate statements of support for issues that are outside of their products and services, because I see there is a certain amount of disingenuousness about it.”

When a company promotes a stance on a social issue, it is often unclear whether it is supported by the CEO, the board, or the employees.

“ … if it’s separate from the work that they do, or does not relate directly to the structure, that’s where I think it’s a little more difficult to know exactly what the motivation is and whether we can trust it,” says Dean.

“Now, there are certainly times when we need to stand up for our moral beliefs and make public statements, even when we think they’re going to be strongly opposed. But I think I see that as more of an individual obligation rather than a business’s obligation.”

He says, when organisations are considering taking a moral stance, they should first ask themselves:

- Why are you doing it? Is it an honestly-held belief, or marketing?

- Whose views are you representing? What proportion of employees supports your stance?

- Is it any of your business’ business? Does it fit with the values of your organisation?

- Why do it as an organisation, rather than as individuals?

The Ethics Centre is a world leader in assessing cultural health and building the leadership capability to make good ethical decisions in complexity. To arrange a confidential conversation contact the team at consulting@ethics.org.au. Visit our consulting page to learn more.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Relationships

There’s no good reason to keep women off the front lines

Explainer

Business + Leadership, Politics + Human Rights

Ethics Explainer: Universal Basic Income

Opinion + Analysis

Business + Leadership, Relationships, Society + Culture

Renewing the culture of cricket

Opinion + Analysis

Business + Leadership

Why we need land tax, explained by Monopoly

Join our newsletter

BY Fiona Smith

Fiona Smith is a freelance journalist who writes about people, workplaces and social equity. Follow her on Twitter @fionaatwork

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Getting the job done is not nearly enough

Getting the job done is not nearly enough

Opinion + AnalysisBusiness + Leadership

BY Fiona Smith The Ethics Centre 2 MAR 2020

If a company wants to be trusted, it must be much more than merely competent. And, compared with community expectations around ethics, an ability to do the job is a relatively minor concern.

We now know ethical concerns are three times more important than being able to do the job to the expected standard, thanks to a recent global poll by the Edelman Trust Barometer.

Australia has been in a state of distrust for almost a decade, with an increasingly cynical and disappointed public, drip-fed on a regular diet of corporate and institutional scandals.

The recent bushfires made matters worse, with Australians feeling they were no longer in control, according to Edelman Australia CEO Michelle Hutton.

“The lack of empathy, authenticity and communications crushed trust across the country,” she told the Australian Financial Review.

The majority of the mass population do not trust their institutions to do what is right, according to the Barometer.

Executive director of The Ethics Centre, Dr Simon Longstaff, warns that important institutions in Australia are getting “perilously close” to losing their legitimacy – which creates anger, insecurity and fear.

None of those things allow a society to enjoy the kind of settled peace that it would aspire to, he said recently.

“Trust is an issue because most of our institutions have betrayed their purpose. I don’t think they set out to do it in a deliberate way. I think they forgot their purpose, whether it’s churches or banks or in politics,” he said on the ABC’s Q&A programme in February.

Longstaff defines trust as an ability to rely on somebody to do what they have said, even when no one is watching them.

The Edelman Trust Barometer divides company trust scores into four elements, and ability (or competence) accounted for 24% of the total. Ethical concerns make up the remainder: integrity 49%, purpose 12%, and dependability 15%.

The researchers find the reason for the general lack of trust in institutions is that none are regarded as both competent and ethical.

Among the institutions – business, government non-government organisations (NGOs) and the media – only the NGOs were seen as ethical (but not competent) and only business was found to be competent (but not ethical).

Part of the explanation for the poor regard for business ethics could be explained by the tendency of companies to give a higher priority to communicating their performance than their commitment to ethics and integrity, or their purpose and vision for the future, say the researchers.

“At the same time, stakeholder expectations have risen,” they say.

“Consumers expect the brands they buy to reflect their values and beliefs, employees want their jobs to give them a sense of purpose, and investors are increasingly focused on sustainability and other ethical commitments as a sign of a company’s long-term operational health and success.

“Business is already recognised for its ability to get things done. But to earn trust, companies must make sure that they are acting ethically, and doing what is right. Because for today’s stakeholders, competence is not enough.”

Dr Longstaff says regaining trust starts with owning up to mistakes.

“What we can expect of ourselves firstly sincerity, and then think before you act. Do that, and you can reasonably be assured that the trust that you hope for will be bestowed.”

How to rebuild trust:

Adopting a minimum threshold of fundamental values and principles can restore trust and minimise the risk of corporate failure.

- Respect people. Everyone has intrinsic value – regardless of their age, gender, culture, and sexual orientation. A person should never be used merely as a means to an end or as a commodity. This principle forbids wrongs, such as forced labour and supports the practice of stakeholder engagement.

- Do no harm. The goods and services should confer a net benefit to users without doing harm. Those who profit from engaging in harmful activity should disclose the nature of the risk.

- Be responsible. Benefits should be proportional to responsibility. One should look beyond artificial boundaries (such as the legal structures of corporations) to take into account the “natural” value-chain, such as how supply chains are viewed and concerning matters like corporate tax and its avoidance and evasion. This principle takes into account asymmetries in power and information to the detriment of weaker third parties.

- Be transparent and honest. These values are fundamental to the operation of free markets, in which stakeholders can make fully-informed decisions about the extent (of their involvement with the corporation. Corporations need to disclose details of the ethical frameworks that they employ when deciding whether or not a decision is “good” or “right”.

Source: Edelman Trust Barometer. An online survey in 28 markets of more than 34,000 people. Fieldwork was conducted between October 19 and November 18, 2019. A supplementary study was conducted in Australia in February 2020 to account for the bushfires. In Australia, 1,350 people were polled.

The Ethics Centre is a world leader in assessing cultural health and building the leadership capability to make good ethical decisions in complexity. To arrange a confidential conversation contact the team at consulting@ethics.org.au. Visit our consulting page to learn more.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

Do organisations and employees have to value the same things?

Opinion + Analysis

Business + Leadership

Between frenzy and despair: navigating our new political era

Opinion + Analysis

Business + Leadership, Health + Wellbeing

Navigating a workforce through stressful times

Opinion + Analysis

Business + Leadership

Taking the bias out of recruitment

BY Fiona Smith

Fiona Smith is a freelance journalist who writes about people, workplaces and social equity. Follow her on Twitter @fionaatwork

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

How ‘ordinary’ people became heroes during the bushfires

How ‘ordinary’ people became heroes during the bushfires

Opinion + AnalysisBusiness + Leadership

BY Fiona Smith The Ethics Alliance The Ethics Centre 2 MAR 2020

As Australians watched their country burn over the summer school holidays, we were all given an unforgettable reminder about what leadership in a crisis looks like.

We now know it looks like the 150,000 volunteer firefighters across Australia who left their families to face down monster infernos, making split-second decisions to attempt a rescue or save themselves.

The face of leadership is covered by a protective mask on an 11-year-old Mallacoota boy, Finn Burns at the helm of an outboard motor, steering to safety his mother, brother and family dog. Behind them, the sky glows a dirty blood-red as if from another planet.

Leadership is embodied in all the so-called “ordinary” people who leapt into action with garden hoses, set up evacuation centres, jumped into their boats to ferry supplies to cut-off communities, launched fundraisers and scoured the smouldering landscape to rescue wildlife.

These leaders took the initiative when the authorities were unavailable or overwhelmed by the scope of the disaster.

Everyday Australians stepping up

NSW Transport Minister and Malua Bay resident, Andrew Constance, recounted on ABC’s Q&A program: “There were community relief centres that were set up immediately after that fire event, without the involvement of government. That was what was heartening. It was in Cobargo, Quaama, everywhere.

“I think the passion that people brought to that period, immediately after those nasty fire events, was something special. So, you can’t bottle it, you can’t pay for it, government can’t deliver it.”

Sitting in the ABC’s studio in Queanbeyan, just days after fighting fires on his own property and evacuating to the beach, the enormity of the experience was written on his exhausted face. He spoke about how he was still reeling and would get counselling to help through the aftermath.

Leadership consultant, Wayne Burns, lost a house at Lake Conjola to the fires and reflected on the difference between leadership and authority, penning an opinion piece in the Sydney Morning Herald.

“Leadership is an art exercised and practised deliberately. It is about influencing, encouraging, inspiring, and sometimes pushing and cajoling without being asked,” he writes.

“Leadership does not require authority, although it helps if a leader has the authority to direct and command resources.”

Filling a leadership vacuum

Speaking to The Ethics Centre of his experience at Lake Conjola, Burns says: “The people who had authority were overwhelmed. A lot was happening very quickly.”

He says that while those in government and emergency services were doing their best, they could not step beyond the authority of their official roles.

This created a “vacuum” which was filled by people who did not have authority, he says. These people took the initiative to do what needed to be done, commandeering water tanks and tools and making decisions about the property of other people.

“They stepped out of their everyday role, whether this was as a neighbour or as a retired person, and they created themselves a position of informal leadership.”

In Burns’ street, a retired engineer stayed behind in his home and became the unofficial spokesperson and decision-maker for around 24 neighbours. He negotiated with utilities companies, organised for dangerous trees to be cut down, helped Police track down residents, obtained access for insurance assessors, and arranged for spraying for asbestos.

“We all gave him informal power to make decisions on our behalf because we knew he had our interests at heart and we knew he was capable and we trusted him. So, it’s a transfer of trust from those with formal authority to those with informal authority,” says Burns, who studied leadership at the John F. Kennedy School of Government at Harvard University.

US management consultant, Gary Hamel, says people who wonder if they are a leader should imagine themselves with no power.

“If, given this starting point, you can mobilise others and accomplish amazing things, then you’re a leader. If you can’t, well then, you’re a bureaucrat,” writes Hamel in an article with Polly LaBarre.

Withdrawing consent to be led

Burns says Australians traditionally have a respect for authority and become indignant if officials let them down. When that happens, they may refuse to recognise the legitimacy of those leaders.

In January, angry Cobargo, NSW, locals turned on Prime Minister Scott Morrison, with some refusing to shake his hand. “In that situation, the Prime Minister has the authority, but he wasn’t afforded the informal leadership by those people, who had withdrawn from him their permission for him to lead them,” says Burns.

Policies, procedures and protocol can constrain people in authority. However, in a crisis, greater leadership can sometimes be shown by those who step beyond their authorised roles. Burns points to Minister Constance, who broke ranks politically to criticise the Federal Government’s response to the bushfire emergency.

Minister Constance told a television interviewer that the Prime Minister had probably “got the welcome he deserved” when he visited Cobargo without alerting Constance, who is the local member.

He also criticised some of the nation’s well-known charities for their slowness in delivering aid.

Burns says that Minister Constance demonstrated natural leadership in his actions facing into the crisis.

“He stepped up and he really led that community because he knew what was happening, he knew what they needed. He really did stick his neck out and rock the boat,” says Burns of Constance.

But it’s also okay to be a follower

Burns says the people most likely to step up into informal leadership have self-belief and some understanding of the legal or physical risks they are taking. “There is no personality type, there are no natural-born leaders – they don’t exist – people just decide to act.”

Burns says there is also nothing wrong with being a follower: “Not everyone wants, or can, lead.” The role those individuals can play is to put their trust into someone who has their confidence. “That person may not know the answer, but can bring people together to get the answer.”

If you are interested in discussing any of the topics raised in this article in more depth with The Ethics Centre’s consulting team, please make an enquiry via our website.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership

It’s time to talk about life and debt

Opinion + Analysis

Business + Leadership, Society + Culture

The Ethics Centre: A look back on the highlights of 2018

Opinion + Analysis

Business + Leadership

Hindsight: James Hardie, 20 years on

Opinion + Analysis

Business + Leadership, Health + Wellbeing, Society + Culture

Ethical concerns in sport: How to solve the crisis

BY Fiona Smith

Fiona Smith is a freelance journalist who writes about people, workplaces and social equity. Follow her on Twitter @fionaatwork

BY The Ethics Alliance

The Ethics Alliance is a community of organisations sharing insights and learning together, to find a better way of doing business. The Alliance is an initiative of The Ethics Centre.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

How to build a successful culture

How to build a successful culture

Opinion + AnalysisBusiness + Leadership

BY The Ethics Centre 2 MAR 2020

They say that what gets measured, gets managed (or improved). But when it comes to measuring corporate culture, that’s an idea that needs unpacking.

The corporate sector has traditionally taken a quantitative approach to risk management and governance. Compliance, regulation, risk and legislative frameworks are applied, analysed, audited and reported-on to varying degrees of accuracy and certainty.

Unfortunately, these management mechanisms do not in themselves lead to effective governance as evidenced by a multitude of corporate scandals and collapses. Overconfidence in the science of risk management can lead to faulty corporate governance – and could well lead to disaster.

The art of risk management and governance lies in the capability of directors and executives to navigate and understand the highly complex and unpredictable set of human behaviours and interactions that make up a modern organisation.

The current scientific approach to risk management is insufficient when seeking to mitigate non-financial risks to business success – leaving companies vulnerable to catastrophic levels of exposure. There is now a shift in thinking and an appreciation that the intangible qualities of culture are critical to the issue of risk management and corporate governance.

Can you measure culture?

The subtle aspects of an organisation, such as values, motivations and political dynamics, are difficult to measure, influence and describe, let alone govern effectively. Performance management and processes, culture and engagement surveys, leadership competency assessments and organisational development initiatives are designed to create visibility of these aspects of organisations, but they often fall short by not accounting for the hidden, unspoken and un-self-aware aspects of human agents and the social systems in which they operate.

For over 20 years The Ethics Centre has been developing a unique approach to navigating these complexities – and, in the process, to accurately measure and understand culture.

Our Everest process assesses the level to which an organisation’s lived culture, and the actual systems and processes that drive the business, align with their intended ethical framework. Through in-depth exploration and analysis, gaps between the ideal and the actual culture of a business emerge, along with areas where formal systems and behaviours are misaligned to the stated values and principles.

Everest digs far deeper than a standard organisational review, identifying themes that relate to experiences over time and between groups of people, and reflecting them against the organisation’s formal policies and procedures. It enables companies to build a climate of trust for clients, shareholders and regulators; to unify employees around a common purpose and encourage values-aligned behaviour; to develop consistency between what you say you believe in and how you act; and to enable consistent decision making. Ultimately reducing the risk of ethical failure and poor decisions.

The Ethics Centre’s Everest process is a tried and tested methodology that produces invaluable insights and recommendations for change. In just the past five years, Everest has been deployed to assess the organisational culture of one of Australia’s largest banks, a major superannuation fund, a leading energy company, a major telco, a mining company and a wagering company – amongst many others.

Transforming organisations

Whilst most of our clients have chosen to keep their Everest reports confidential, two recent clients – The Australian Olympic Committee and Cricket Australia – elected to publicly release the reports into their organisations.

In both instances, these acts of “radical transparency” acted as a circuit-breaker following periods of widespread negative coverage. The release of these reports allowed the organisations to re-boot with renewed purpose and energy.

According to Matt Carroll, the widely-respected CEO of the AOC, “the review conducted by The Ethics Centre provided us with the platform to reset the organisation. We are committed to building a culture that is fit for purpose and aligned to our values and principles.”

Our report on Cricket Australia – following the infamous ball-tampering incident in 2018 – ran to 147 pages and contained 42 detailed recommendations. Our key finding was that a focus on winning had led to the erosion of the organisation’s culture and a neglect of some important values. Aspects of Cricket Australia’s player management had served to encourage negative behaviours.

It was clear, with the release of the report, that many things needed to change at Cricket Australia. And change they did. Cricket Australia committed to enacting 41 of the 42 recommendations made in the report, along with widespread renewal of their executive team and board.

“With culture, it’s something you’ve got to keep working at, keep your eye on, keep nurturing,” says CA’s chairman Earl Eddings. “It’s not: we’ve done the ethics report, so now we’re right.”

Most of the corporate collapses and scandals that have occurred lately were not the result of inadequate risk management, poorly crafted strategy or an absence of appropriate policies. Nor were they caused by incompetence or poorly trained staff.

In almost every case, it is becoming apparent that the causes lay in the psychology, ethics and beliefs of individuals and in an organisational culture that rewards short term value extraction over long term, sustainable value creation.

This misalignment between the espoused purpose, values and principles of an organisation and the real-time decisions being made each day can increase reputational and conduct risk leading to an erosion of trust, disengagement and poor customer outcomes.

Even companies with no burning platform benefit from the rigorous corporate health-check that Everest provides. To quote Ian Silk, CEO of another Everest client Australian Super:

“In my darkest moments I just wondered if we had all drunk the Kool-Aid, and whether the staff surveys reflected the facts. So I thought a really good way to test this would be to get The Ethics Centre to come in and do an entirely independent, entirely objective test of the culture and the ethics in the organisation.”

If you are interested in discussing any of the topics raised in this article in more depth with The Ethics Centre’s consulting team, please make an enquiry via our website.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Business + Leadership, Health + Wellbeing

David Pocock’s rugby prowess and social activism is born of virtue

Opinion + Analysis

Business + Leadership

What are millennials looking for at work?

Opinion + Analysis

Business + Leadership

Understanding the nature of conflicts of interest

Opinion + Analysis

Business + Leadership, Society + Culture

The Ethics Institute: Helping Australia realise its full potential

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Ready or not – the future is coming

Ready or not – the future is coming

Opinion + AnalysisBusiness + Leadership

BY John Neil The Ethics Centre 2 MAR 2020

We are living in an exceptional era of human history. In a blink of the historical time scale, our species now have the skills to explore the universe, map and modify human genes and develop forms of intelligence that may far surpass their creators.

In fact, given the speed, unpredictability and sheer scale of what was previously unthinkable change, it’s actually better to talk of the future in the plural rather than the singular: the ‘futures’ are coming.

With the convergence of genetic engineering, AI and neurotechnology, entirely unique challenges arise that could test our assumptions about human identity and what connects us together as a species. What does the human experience mean in an era of augmentation, implantation, enhancement and editing of the very building blocks of our being in the future? What happens when we not only hack the human body, but the human mind?

The possible futures that are coming will arrive with such speed that those not ready for them will find themselves struggling to know how to navigate and respond to a world unlike the one we currently know. Those that invest in exploring what the future holds will be well placed to proactively shape their current and future state so they can traverse the complexity, weather the challenges, and maximise the opportunities the future presents.

The Ethics Centre’s Future State Framework is a tailored, future-focused platform for change management, cultural alignment and staff engagement. It draws on futuring methodologies, including trend mapping and future scenario casting, alongside a number of design thinking and innovation methodologies. What sets Future State apart is that it incorporates ethics as the bedrock for strategic and organisational assessment and design. Ethics underpins every aspect of an organisation. An organisation’s purpose, values and principles set the foundation for its culture, gives guidance to leadership, and sets the compass needed to execute strategy.

The future world we inhabit will be built on the choices we make in the present. Yet due to the sheer complexity of the multitudes of decisions we make every day, it’s a future that is both unpredictable and emergent. The laws, processes, methods and current ways of thinking in the present may not serve us well in the future, nor contribute best to the future that we want to create. By envisioning the challenges of the future through an ethics-centred design process, the Future State Framework ensures that organisations and their culture are future-proof.

The Future State Framework has supported numerous organisations in reimagining their purpose and their unique economic and social role in a world where profit is rapidly and radically being redefined. Shareholder demand is moving beyond financial return, and social expectations toward the role of corporations are shifting dramatically into the future.

The methodology helps organisations chart a course through this transformation by mapping and targeting their desired future state and developing pathways for realising it. It been designed to support and guide both organisations facing an imminent burning platform and those wanting to be future forward and leading – giving them the insight to act with purpose – fit for the many possibilities the future might hold.

If you are interested in discussing any of the topics raised in this article in more depth with The Ethics Centre’s consulting team, please make an enquiry via our website.

Ethics in your inbox.

Get the latest inspiration, intelligence, events & more.

By signing up you agree to our privacy policy

You might be interested in…

Opinion + Analysis

Society + Culture, Business + Leadership, Health + Wellbeing

Make an impact, or earn money? The ethics of the graduate job

Opinion + Analysis

Business + Leadership, Relationships

There’s no good reason to keep women off the front lines

Opinion + Analysis

Business + Leadership

Capitalism is global, but is it ethical?

Opinion + Analysis

Business + Leadership, Science + Technology

Big tech knows too much about us. Here’s why Australia is in the perfect position to change that

BY John Neil

As Director of Education and Innovation at The Ethics Centre, John collaborates closely with a talented team of specialists and subject matter experts to shape the tools, frameworks, and programs that drive our work forward. He brings a rich and varied background as a consultant, lecturer, and researcher, with expertise spanning ethics, cultural studies, sustainability, and innovation. This multidisciplinary perspective allows him to introduce fresh, thought-provoking approaches that energise and inspire our initiatives. John has partnered with some of Australia’s largest organisations across diverse industries, to place ethics at the heart of organisational life. His work focuses on education, cultural alignment, and leadership development to foster meaningful and lasting impact.

BY The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing innovative programs, services and experiences, designed to bring ethics to the centre of professional and personal life.

Ethics in the Boardroom

Ethics in the Boardroom: A Decision-Making Guide for Directors

Ethics in the Boardroom: A Decision-Making Guide for Directors

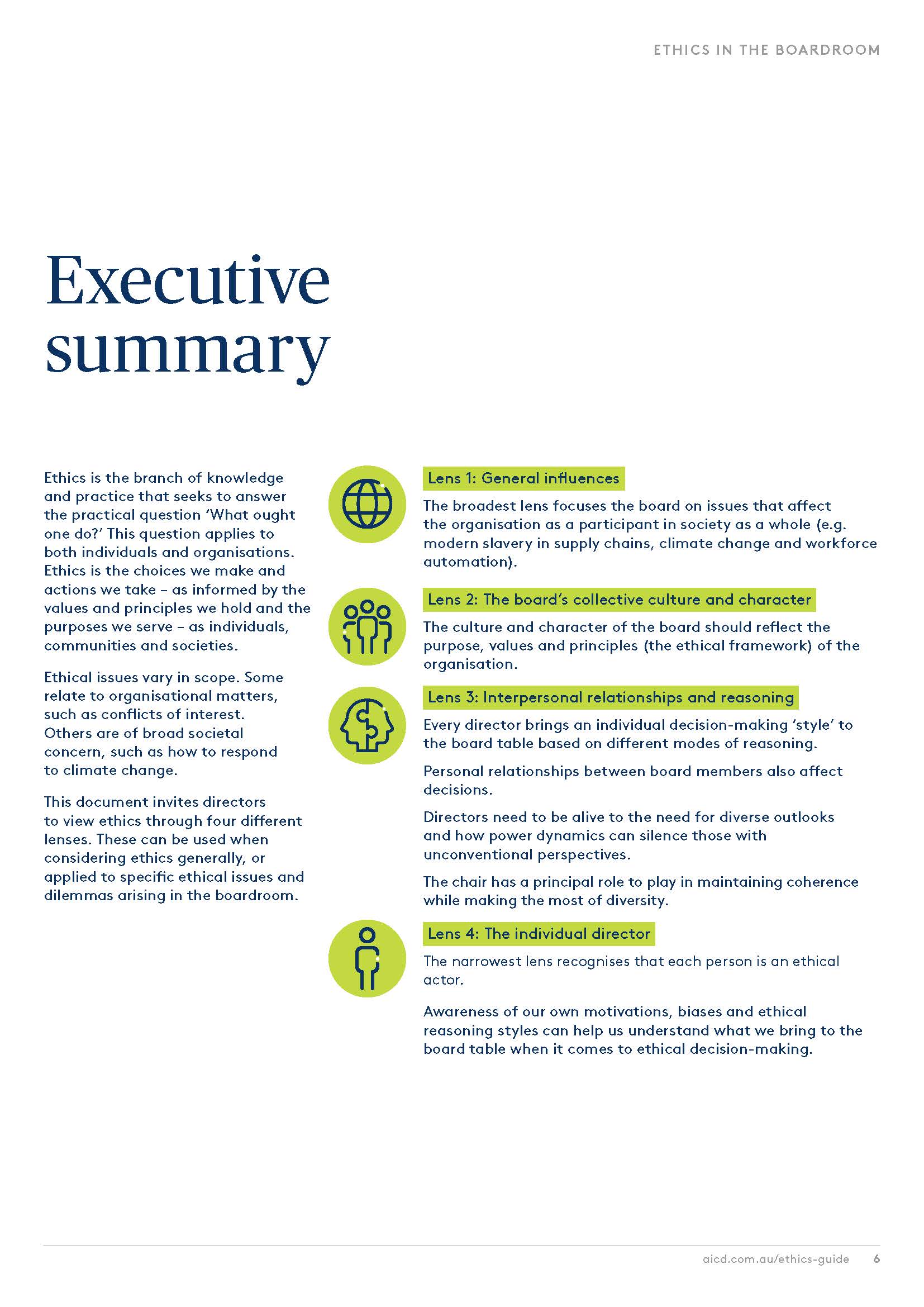

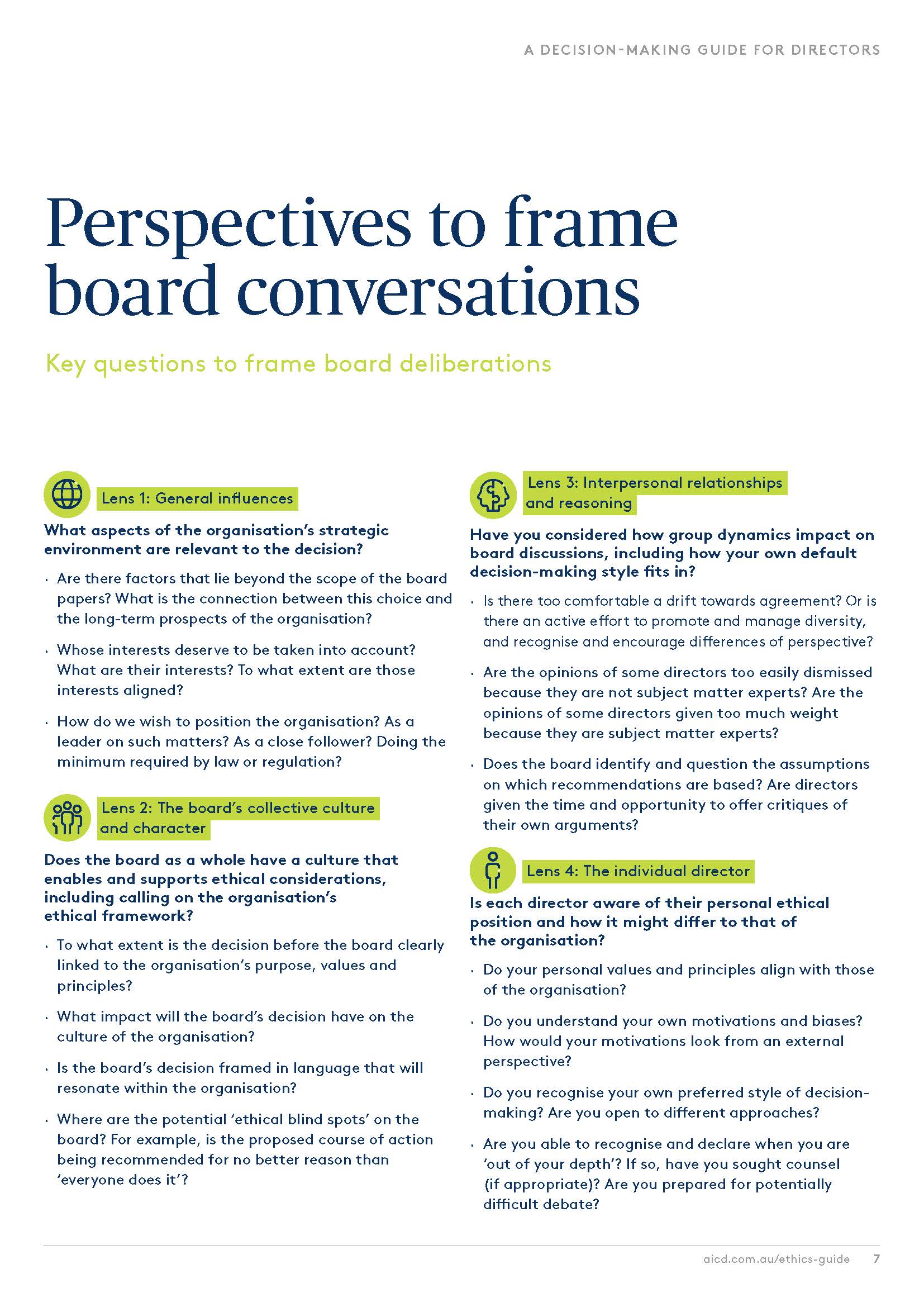

The role of a director in governing an organisation is made more complex by a myriad of ethical issues that impact on board decision-making. Boardroom practices are also central to setting the right tone and values throughout an organisation.

Ethics in the Boardroom: A Decision-Making Guide has been developed in collaboration with the Australian Institute of Company Directors. Designed to support directors in considering ethical issues as they discharge their duties, it invites them to view the decisions they come up against through four key lenses.

This report is a vital resource for directors as a general reference, should be utilised by boards to strengthen their capacity in ethics, and by individual directors and boards alike to inform conversations about the complex issues they encounter in their roles.

"The the board of a corporation is, in effect, its mind and conscience. All that a corporation does and its effects on the world, is ultimately traced back to directors and their deliberations."

DR SIMON LONGSTAFF AO

WHATS INSIDE?

Understanding Ethics

Perspectives to frame board conversations

A decision making framework

General influences

The board’s collective culture and character

Interpersonal relationships and reasoning

The individual director

Practical Examples

Whats inside the guide?

AUTHORS

Authors

The Ethics Centre

The Ethics Centre is a not-for-profit organisation developing and delivering innovative programs, services and experiences, designed to bring ethics to the centre of personal and professional life. Our activities span ethics consulting and leadership for organisations from all sectors and of all sizes, Ethi-call, our free ethics helpline, live events, and advocacy campaigns. Our work brings people together to build their skills and capacity to live and act according to their values.

Australian Institute of Company Directors

The Australian Institute of Company Directors is committed to strengthening society through world-class governance. They aim to be the independent and trusted voice of governance, building the capability of a community of leaders for the benefit of society. Their membership of more than 45,000, includes directors and senior leaders from business, government and the not-for-profit sectors.

DOWNLOAD A COPY

You may also be interested in...

Nothing found.